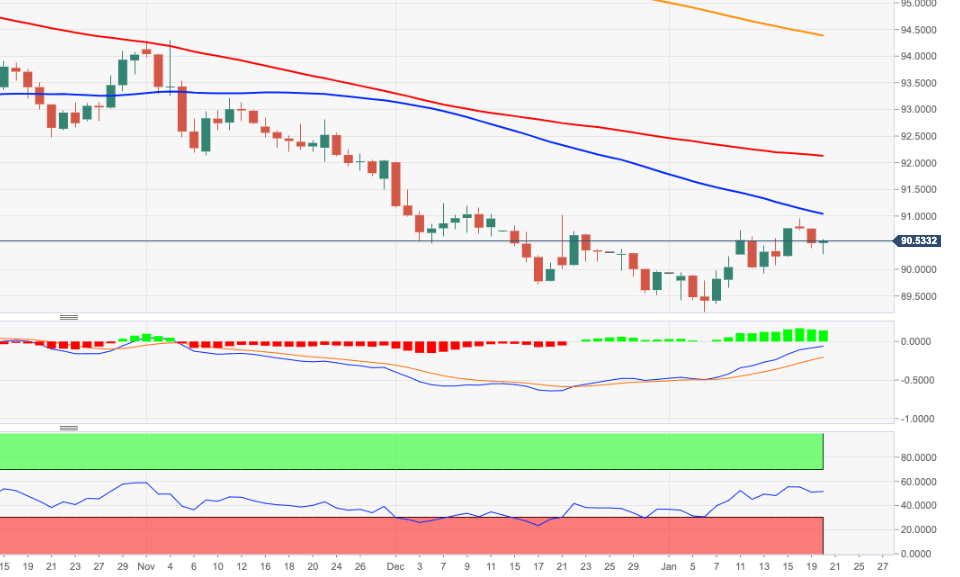

- DXY regains some composure and reverses the initial weakness.

- Interim hurdle lines up at the 91.00 neighbourhood.

DXY met buyers in the 90.30 region earlier on Wednesday and now resumes the upside to the 90.50/55 band.

Despite the ongoing rebound, the prospect for the greenback remains tilted to the bearish side. That said, a re-visit of the 90.00 yardstick should not surprise anyone in the short-term horizon. Below this psychological level is located the 2021 lows around 89.20 ahead of the March 2018 low at 88.94.

Immediately to the upside emerges the next target at the recent yearly peaks in the 91.00 region. The 55-day SMA, today ay 91.04, reinforces this resistance. Above this region, the selling pressure is forecast to mitigate somewhat.

The ongoing rebound is seen as corrective only and in the longer run, as long as DXY trades below the 200-day SMA, today at 94.37, the negative view is expected to persist.

DXY daily chart