- The index climbs near the 97.00 handle post-CPi.

- Yields of the US 10-year note print tops around 2.70%.

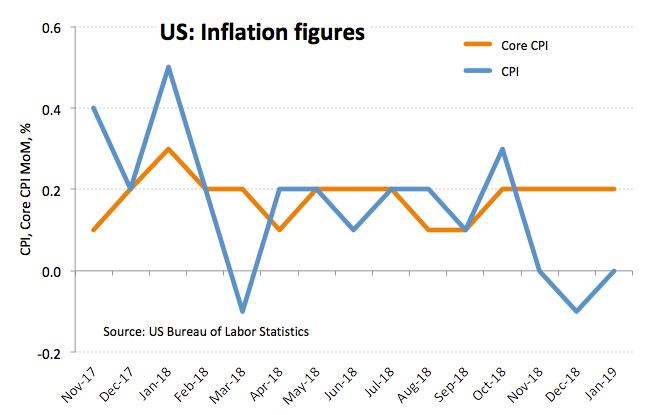

- US Core CPI surprised to the upside in January.

The greenback, in terms of the US Dollar Index (DXY), has regained the upside momentum and is now approaching the critical 97.00 handle.

US Dollar Index bid on data, yields

The index has reverted the initial pessimism and is now back to the positive territory near 97.00 the figure following auspicious results from US inflation figures, higher yields in the US money markets and recent comments noting the final word on the US-China trade talks hinges on an eventual Trump-Xi meeting.

In fact, headline CPI came in flat on a monthly basis during the first month of the year and rose at an annualized 1.6%. Further data saw Core prices rising 0.2% inter-month and 2.2% from a year earlier.

The rebound in DXY has been so far in tandem with the uptick in yields of the US 10-year note to daily tops beyond 2.70%.

Further news around the buck noted Cleveland Fed L.Mester said the Fed is now in a ‘wait and see’ mode, adding that the economy is expected to have a solid performance this year, despite a projected slower pace of growth.

What to look for around USD

Alternating news and rumours on the US-China trade talks remain poised to add volatility both to the greenback and riskier assets in the very near term. However, weakness in overseas economies (vs. solid US fundamentals) plus G10 central banks re-shifting to a neutral/dovish stance have been sustaining the upbeat momentum in the greenback since the start of February, while scepticism over a potential halt in the Fed’s tightening cycle remains on the rise and is also lending extra legs to the index.

US Dollar Index relevant levels

At the moment, the pair is advancing 0.30% at 96.99 and a break above 97.20 (2019 high Feb.12) would aim for 97.71 (2018 high Dec.14) and finally 97.87 (monthly high Jun.20 2017). On the downside, the initial support aligns at 96.41 (55-day SMA) followed by 96.22 (38.2% Fibo of the September-December up move) and then 96.18 (21-day SMA).