- DXY reverses Monday’s moderate pullback and retests 92.70/75.

- US 10-year yields rebound from lows near 1.68%.

- IBD/TIPP Index, JOLTs Job Openings, API report next on tap.

The greenback, in terms of the US Dollar Index (DXY), manages to regain the smile and advances to the 92.70/75 band on turnaround Tuesday.

US Dollar Index looks to yields, data

The index leaves behind Monday’s important pullback and re-visits the 92.70/75 band, as investors keep the positive view around the US economic recovery, US yields creep higher and recent positive results from key fundamentals collaborate with the upbeat scenario surrounding the buck.

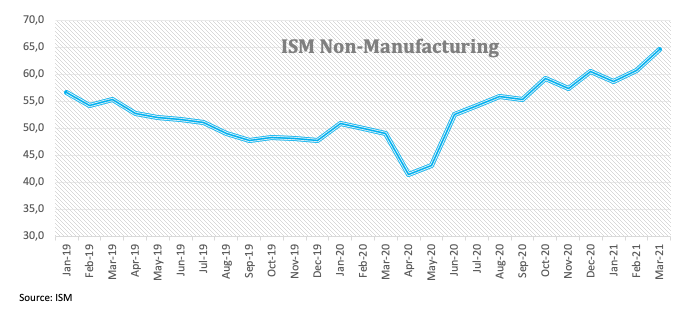

In fact, yields of the key US 10-year reference regain the 1.70% neighbourhood following a brief drop to the 1.68% zone. In addition, the record high level of Friday’s ISM Non-Manufacturing keeps adding to the solid pace of the index.

Later in the session, the IBD/TIPP Economic Optimism index is due seconded by JOLTs Job Openings, while the weekly report on US crude oil inventories by the API will close the docket later on Tuesday.

What to look for around USD

The upside momentum in the dollar faltered ahead of the 93.50 region in past sessions, sparking a corrective downside to the vicinity of the key 200-day SMA around 92.40. In addition, the recently approved fiscal stimulus package adds to the ongoing outperformance of the US economy narrative as well as the investors’ perception of higher inflation in the next months, all morphing into extra oxygen for the dollar. However, the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made) and hopes of a strong global economic recovery (now postponed to later in the year) remain a source of support for the risk complex and carry the potential to curtail the upside momentum in the dollar in the second half of the year.

Key events in the US this week: FOMC Minutes (Wednesday) – initial Claims, Powell’s speech (Thursday) – Producer Prices (Friday).

Eminent issues on the back boiler: Biden’s new stimulus bill worth around $3 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is gaining 0.08% at 92.64 and a break above 93.43 (2021 high Mar.31) would expose 94.00 (round level) and finally 94.30 (monthly high Nov.4). On the other hand, the next support emerges at 92.41 (200-day SMA) followed by 91.30 (weekly low Mar.18) and then 91.05 (100-day SMA).