- The greenback stays on the defensive near daily lows.

- US Housing Starts contracted more than expected in December.

- Fed’s Powell will testify before Congress later in the day.

The greenback, in terms of the US Dollar Index (DXY), keeps the offered bias unchanged in the first half of the week and trades near daily lows in the 96.30/25 band.

US Dollar Index looks to Powell

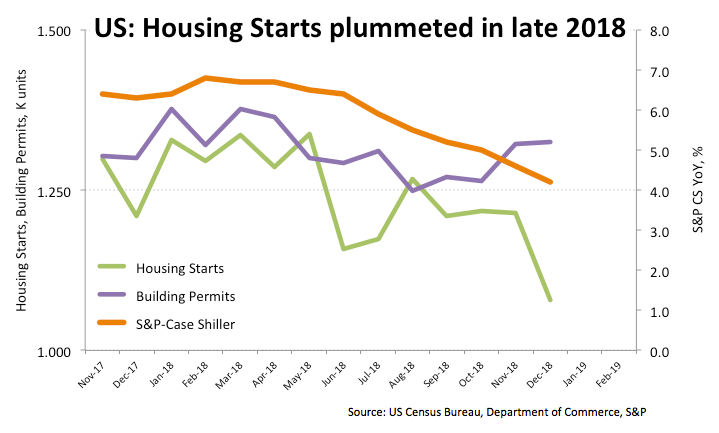

The selling mood around the buck is gathering extra pace today following mixed prints from the US housing sector. In fact, Housing Starts contracted more than 11% MoM during December or 1.078 M units, while Building Permits rose 0.3% MoM, or 1.326M units.

Additional data saw house prices tracked by the S&P/Case-Shiller Index expanding at an annualized non-seasonally-adjusted 4.2%, missing previous estimates.

In the meantime, the buck could face further pressure in light of the upcoming Semi-Annual testimony by Fed’s Powell, where consensus among investors is anticipating a dovish tone.

What to look for around USD

The US-China trade dispute remains in centre stage when comes to drive the global sentiment for the time being. This week will also see the Trump-Kim meeting as a potential driver on the geopolitical side. The release of another estimate of the Q4 GDP (Thursday) will also give markets and idea of how the US economy fared in late 2018. Attention will also be on Chief Powell’s testimonies, where the centre of the debate is expected to gyrate around the Fed’s plans on the balance sheet, the reassessment of the tightening cycle and the renewed patient stance of the Fed.

US Dollar Index relevant levels

At the moment, the pair is losing 0.08% at 96.34 and a breach of 96.25 (low Feb.26) would target 96.22 (38.2% Fibo of the September-December up move) en route to 95.62 (200-day SMA). On the flip side, the initial hurdle aligns at 96.69 (10-day SMA) followed by 97.09 (high Feb.19) and then 97.37 (2019 high Feb.15).