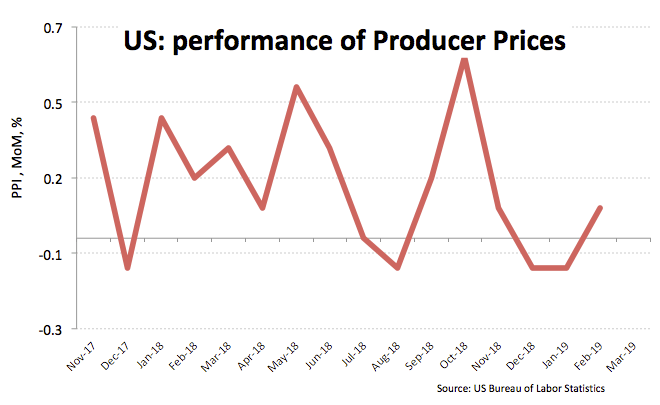

- The index stays depressed in the lower end of the range.

- US Producer Prices rose less than expected in February.

- All the attention remains on Brexit vote later in the day.

The greenback remains on the back footing so far this week, motivating the US Dollar Index (DXY) to drop further south of the 97.00 handle and flirt with multi-day lows in the vicinity of 96.80.

US Dollar Index offered post-US data

The upbeat sentiment around the riskier assets keeps the selling mood in the buck unabated for yet another session, prompting DXY to ease further ground and challenge 5-day lows near 96.80. That said, the 21-day SMA at 96.73 is initially expected to contain further retracements.

The index is also deriving downside pressure after US Producer Prices failed to surprise markets to the upside, advancing 0.1% inter-month in February and 0.1% MoM when comes to Core prices.

In addition, headline Durable Goods Orders came in above expectations, rising 0.4% MoM in January. Core orders, instead, contracted at a monthly 0.1% vs. forecasts for a 0.1% gain.

Later in the day, the generalized risk-on sentiment will be put to the test in light of another vote at the House of Commons, this time on a ‘no deal’ scenario.

What to look for around USD

The optimism around a positive outcome in the US-China trade front faded somewhat in past days and hopes have taken a hit following recent comments from US R.Lighthizer. Despite Payrolls were a fiasco when comes to job creation during last month, the lower unemployment rate and wage inflation expanding at a decade-high pace keep limiting the occasional downside in the buck. Investors, in the meantime, continue to scrutinize the probable change in the Fed’s rate path as well as any re-assessment of the ongoing QT.

US Dollar Index relevant levels

At the moment, the pair is retreating 0.19% at 96.80 and a breach of 96.73 (21-day SMA) would open the door to 96.33 (55-day SMA) and then 95.82 (low Feb.28). On the other hand, the next up barrier is located at 97.71 (2019 high Mar.7) seconded by 97.87 (monthly high Jun.20 2017) and finally 99.89 (monthly high May 11 2017).