- DXY alternates gains with loses just above 91.00.

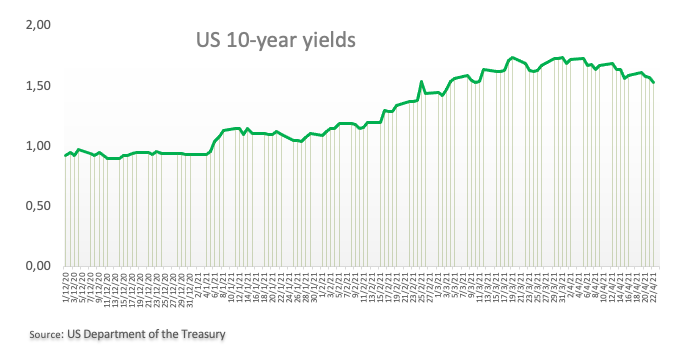

- US 10-year yields edge lower to the 1.53% region.

- Weekly Claims, housing data, CB Leading Index next on tap.

The US Dollar Index (DXY), which tracks the greenback vs. a basket of its main rivals, exchanges gains with losses just above the 91.00 yardstick ahead of the opening bell in Euroland on Thursday.

US Dollar Index now looks to data, ECB

Following Tuesday’s drop to fresh lows in the 90.90/85 band, the index managed to regain some mild upside traction, although it run out of steam in the 91.40 region (Wednesday).

In addition, shrinking US yields remove strength from any bullish attempt in the dollar. Indeed, yields of the key US 10-year benchmark extend the monthly leg lower and slip back to the 1.53% area so far, levels last visited in mid-March.

In the meantime, the recent bout of risk aversion in response to higher volatility and increased coronavirus cases in Asia appears to be dying off, with investors re-shifting their focus to the risk complex.

In the US data space, weekly Initial Claims are due seconded by the Chicago Fed National Activity Index, Existing Home Sales and the CB Leading Index.

Another event of note will be the ECB meeting, where consensus sees the central bank delivering an upbeat assessment of the economy, although keeping the ultra-accommodative stance unchanged.

What to look for around USD

The dollar manages to regain some composure after bottoming out in sub-91.00 levels earlier in the week, always amidst the renewed soft note in US yields and the loss of enthusiasm on the US reflation/vaccine trade. Also weighing on the buck emerges the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made) and hopes of a strong global economic recovery, all morphing into a source of support for the risk complex and a most likely driver of probable weakness in the dollar in the second half of the year.

Key events in the US this week: Initial Claims, CB Leading Index, Biden’s virtual Climate Summit (Thursday) – Flash Markit Manufacturing PMI (Friday).

Eminent issues on the back boiler: Biden’s new stimulus bill worth around $3 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating?

US Dollar Index relevant levels

At the moment, the index is gaining 0.02% at 91.12 and a break above 91.64 (50-day SMA) would open the door to 92.11 (200-day SMA) and finally 93.43 (2021 high Mar.31). On the other hand, the next support emerges at 90.85 (weekly low Apr.20) ahead of 89.68 (monthly low Feb.25) and then 89.20 (2021 low Jan.6).