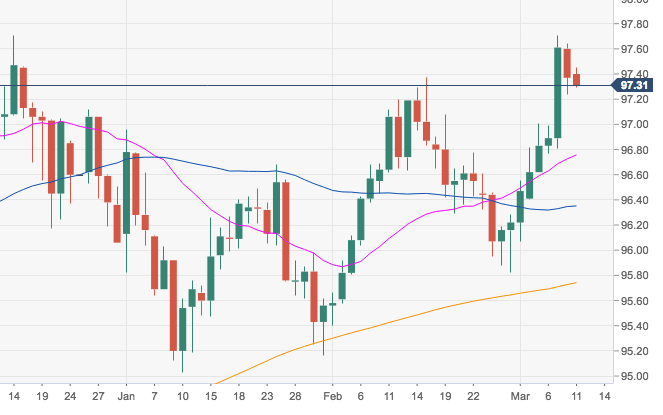

- DXY is losing further ground on Monday, receding to the 97.30 region after climbing to fresh 2019 tops in the 97.70/75 band on Thursday.

- The continuation of the selling impetus is seen facing strong contention in the 96.75 region, where coincide the 21-day and 10-day SMAs.

- The constructive stance in the buck should stay unchanged while above the critical 200-day SMA at 95.74

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 97.32

Today Daily change: 16 pips

Today Daily Open: 97.37

Trends:

Daily SMA20: 96.73

Daily SMA50: 96.3

Daily SMA100: 96.54

Daily SMA200: 95.73

Levels:

Previous Daily High: 97.64

Previous Daily Low: 97.24

Previous Weekly High: 97.71

Previous Weekly Low: 96.4

Previous Monthly High: 97.37

Previous Monthly Low: 95.4

Daily Fibonacci 38.2%: 97.39

Daily Fibonacci 61.8%: 97.49

Daily Pivot Point S1: 97.19

Daily Pivot Point S2: 97.02

Daily Pivot Point S3: 96.79

Daily Pivot Point R1: 97.59

Daily Pivot Point R2: 97.82

Daily Pivot Point R3: 97.99