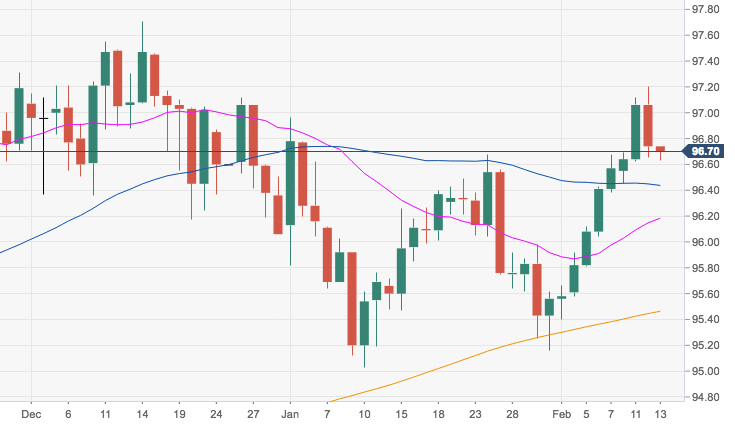

- DXY clinched fresh yearly highs at 97.20 on Tuesday, although sellers turned up soon afterwards, sponsoring the ongoing knee-jerk.

- Initial contention emerges at the 96.40 region, where sits the key 55-day SMA, while the constructive bias is seen unchanged as long as the200-day SMA near 95.50 underpins.

- A surpass of recent YTD peaks should focus the attention on 2018 highs around 97.70.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.71

Today Daily change: 10 pips

Today Daily change %: -0.03%

Today Daily Open: 96.74

Trends:

Daily SMA20: 96.16

Daily SMA50: 96.39

Daily SMA100: 96.29

Daily SMA200: 95.45

Levels:

Previous Daily High: 97.2

Previous Daily Low: 96.65

Previous Weekly High: 96.69

Previous Weekly Low: 95.58

Previous Monthly High: 96.96

Previous Monthly Low: 95.03

Daily Fibonacci 38.2%: 96.86

Daily Fibonacci 61.8%: 96.99

Daily Pivot Point S1: 96.53

Daily Pivot Point S2: 96.31

Daily Pivot Point S3: 95.98

Daily Pivot Point R1: 97.08

Daily Pivot Point R2: 97.41

Daily Pivot Point R3: 97.63