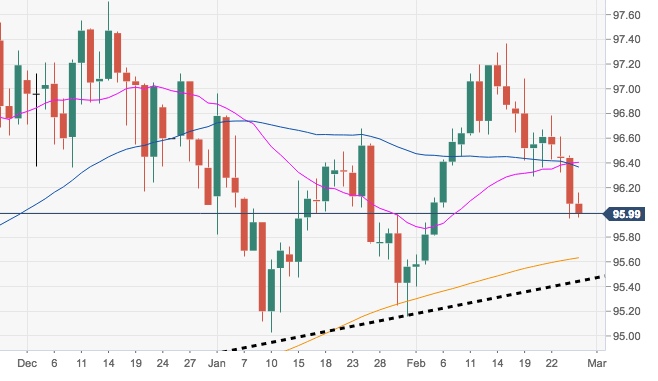

- The index is extending the pullback to fresh lows, briefly breaking below the key support at the 96.00 handle following Powell’s testimony on Tuesday.

- A potential visit to the critical 200-day SMA at 95.63 will be exposed in case the selling mood gathers pace.

- This important area of support is reinforced by the short-term support line, today at 95.44.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.01

Today Daily change: 20 pips

Today Daily change %: -0.06%

Today Daily Open: 96.07

Trends:

Daily SMA20: 96.43

Daily SMA50: 96.31

Daily SMA100: 96.43

Daily SMA200: 95.62

Levels:

Previous Daily High: 96.46

Previous Daily Low: 95.95

Previous Weekly High: 97.08

Previous Weekly Low: 96.29

Previous Monthly High: 96.96

Previous Monthly Low: 95.03

Daily Fibonacci 38.2%: 96.14

Daily Fibonacci 61.8%: 96.27

Daily Pivot Point S1: 95.86

Daily Pivot Point S2: 95.65

Daily Pivot Point S3: 95.35

Daily Pivot Point R1: 96.37

Daily Pivot Point R2: 96.67

Daily Pivot Point R3: 96.88