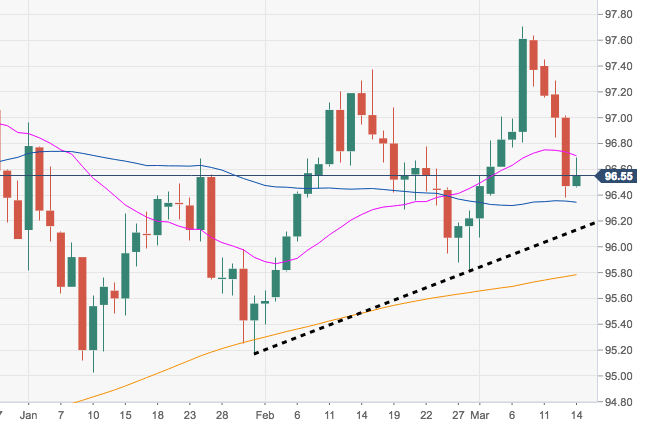

- DXY is attempting a rebound after hitting multi-day lows in the 96.40/35 band on Wednesday.

- Further south, the next support emerges at the 55-day SMA near 96.30 ahead of the short-term support line at 96.13 and late-February lows in the 95.80 region.

- In spite of the underlying weakness, the constructive outlook in DXY is seen unchanged above the critical 200-day SMA, today at 95.78.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.53

Today Daily change: 22 pips

Today Daily change %: 0.06%

Today Daily Open: 96.47

Trends:

Daily SMA20: 96.71

Daily SMA50: 96.33

Daily SMA100: 96.57

Daily SMA200: 95.77

Levels:

Previous Daily High: 97.02

Previous Daily Low: 96.38

Previous Weekly High: 97.71

Previous Weekly Low: 96.4

Previous Monthly High: 97.37

Previous Monthly Low: 95.4

Daily Fibonacci 38.2%: 96.62

Daily Fibonacci 61.8%: 96.78

Daily Pivot Point S1: 96.23

Daily Pivot Point S2: 95.98

Daily Pivot Point S3: 95.59

Daily Pivot Point R1: 96.87

Daily Pivot Point R2: 97.26

Daily Pivot Point R3: 97.51