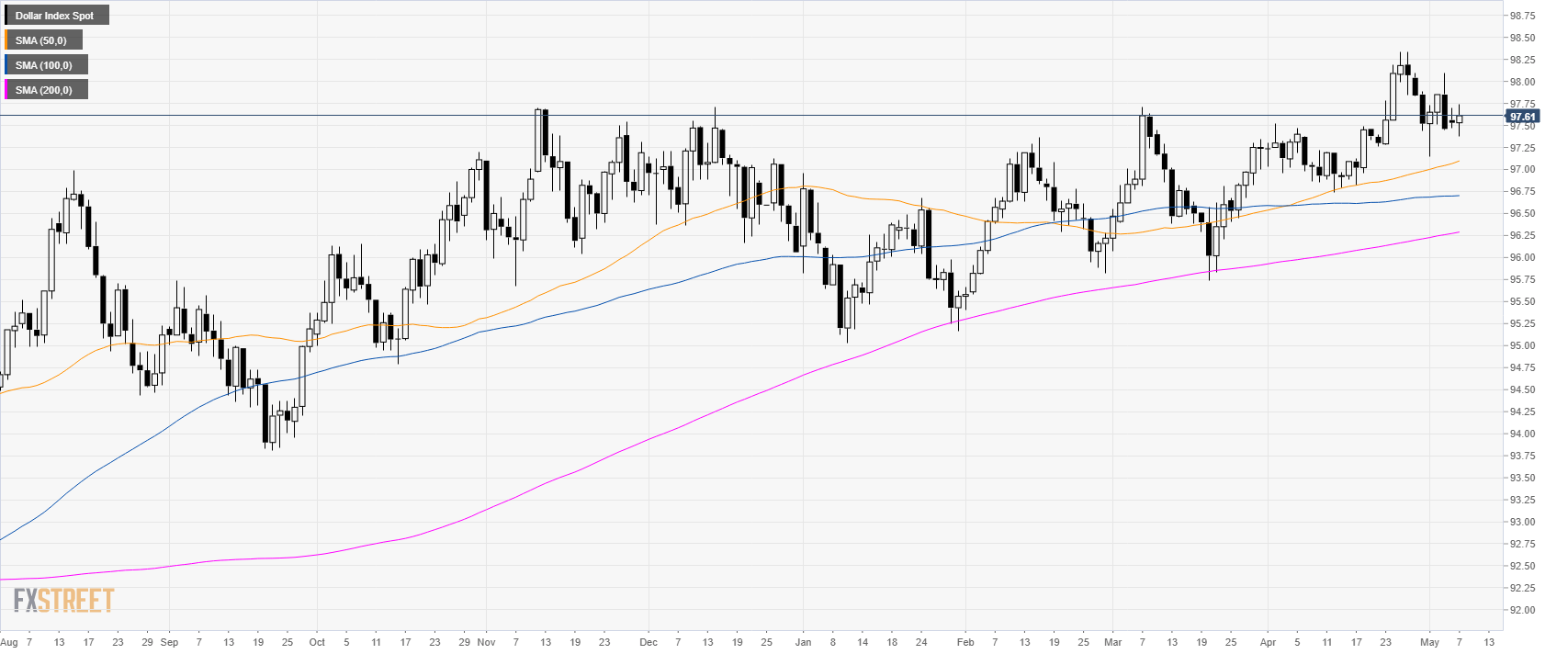

DXY daily chart

- The US Dollar Index (DXY) is trading in a bull trend above its main simple moving averages (SMAs).

- DXY is in demand on the back of US-China trade tensions.

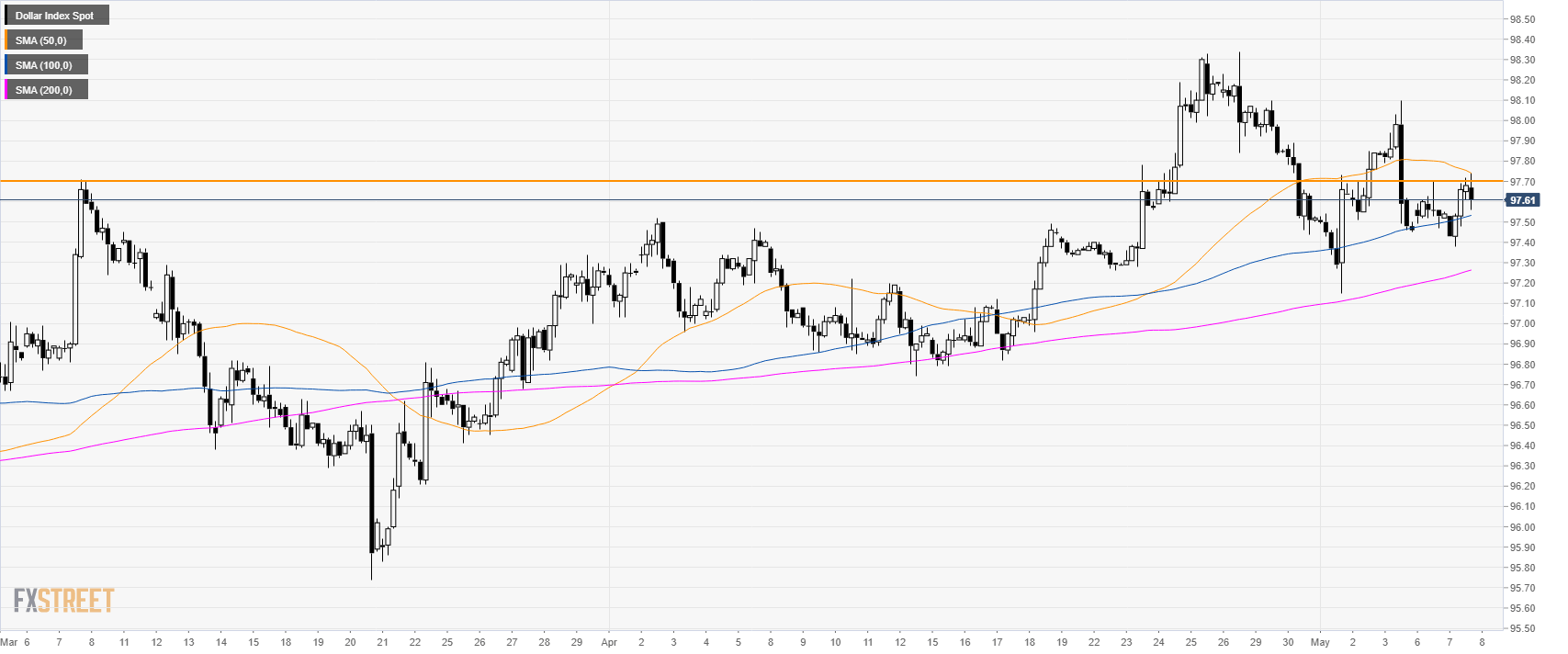

DXY 4-hour chart

- DXY is trading above its main SMAs suggesting bullish momentum in the medium-term.

- 97.70 is the level to beat for bulls.

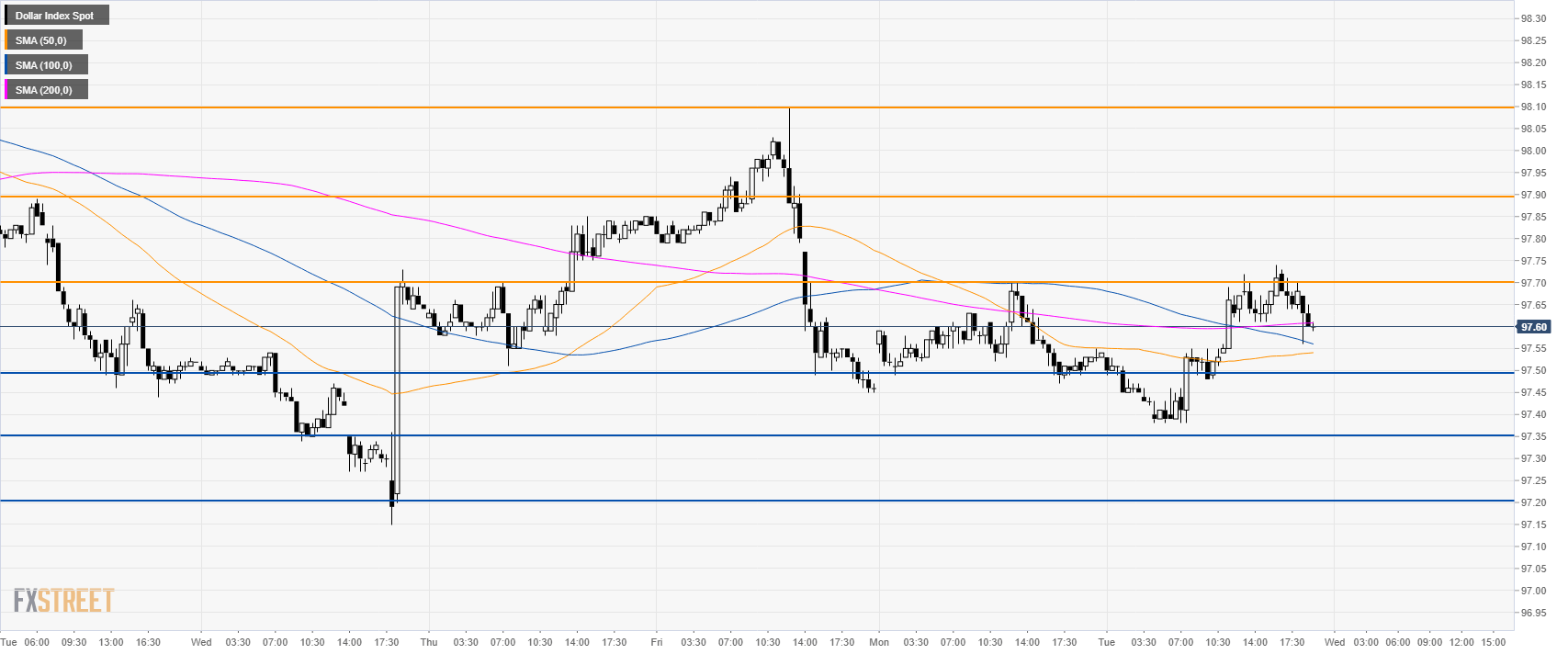

DXY 30-minute chart

- DXY is trading above the 50 and 100 SMAs. However the 200 SMA is flat, all-in-all suggesting a bullish bias in the short-term.

- Buyers created a nice rebound on Tuesday and they will attempt to move beyond 97.70 resistance. A break above this level can lead to 97.90 and 98.10 levels.

- Support is at 97.50, 97.35 and 97.20 level.

Additional key levels