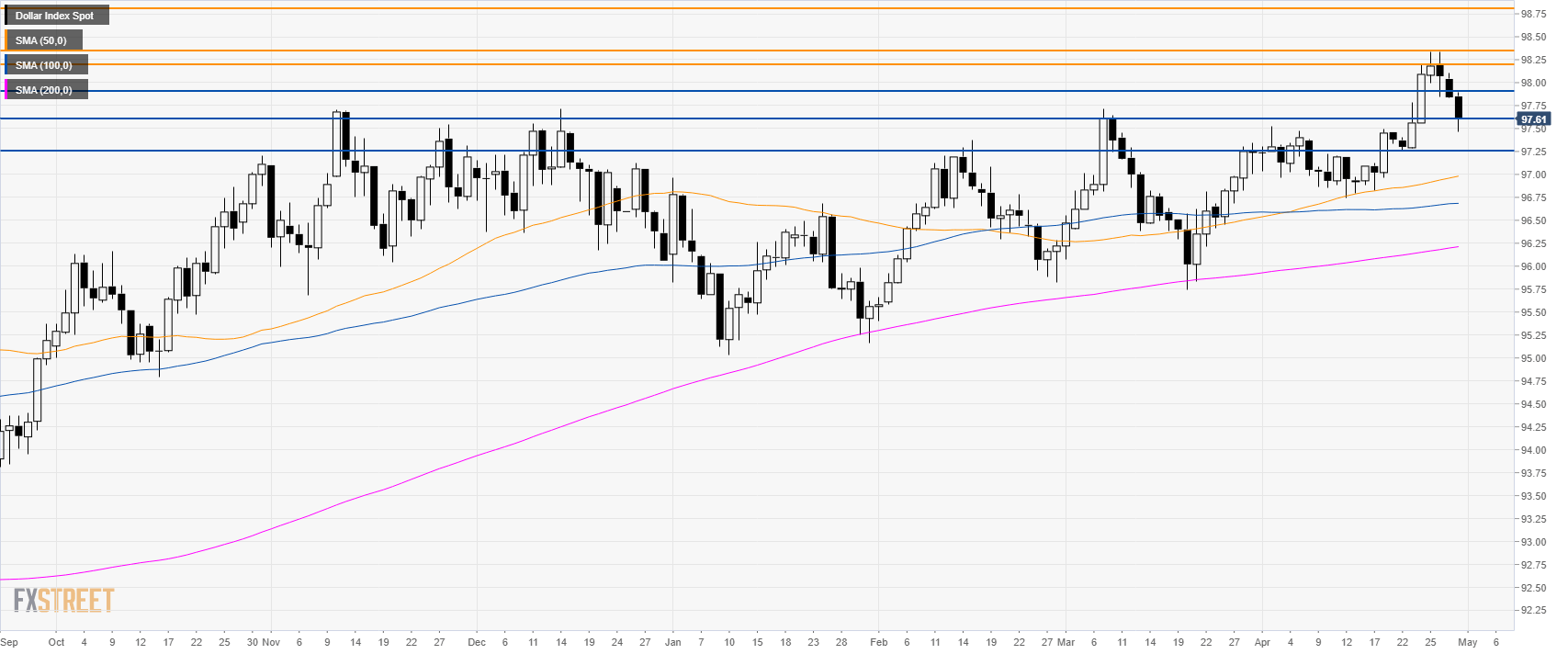

DXY daily chart

- The US Dollar Index (DXY) is trading in a bull trend above its main simple moving averages (SMAs).

- DXY is correcting down for the third day in a row. So far there is no sign that the correction is over.

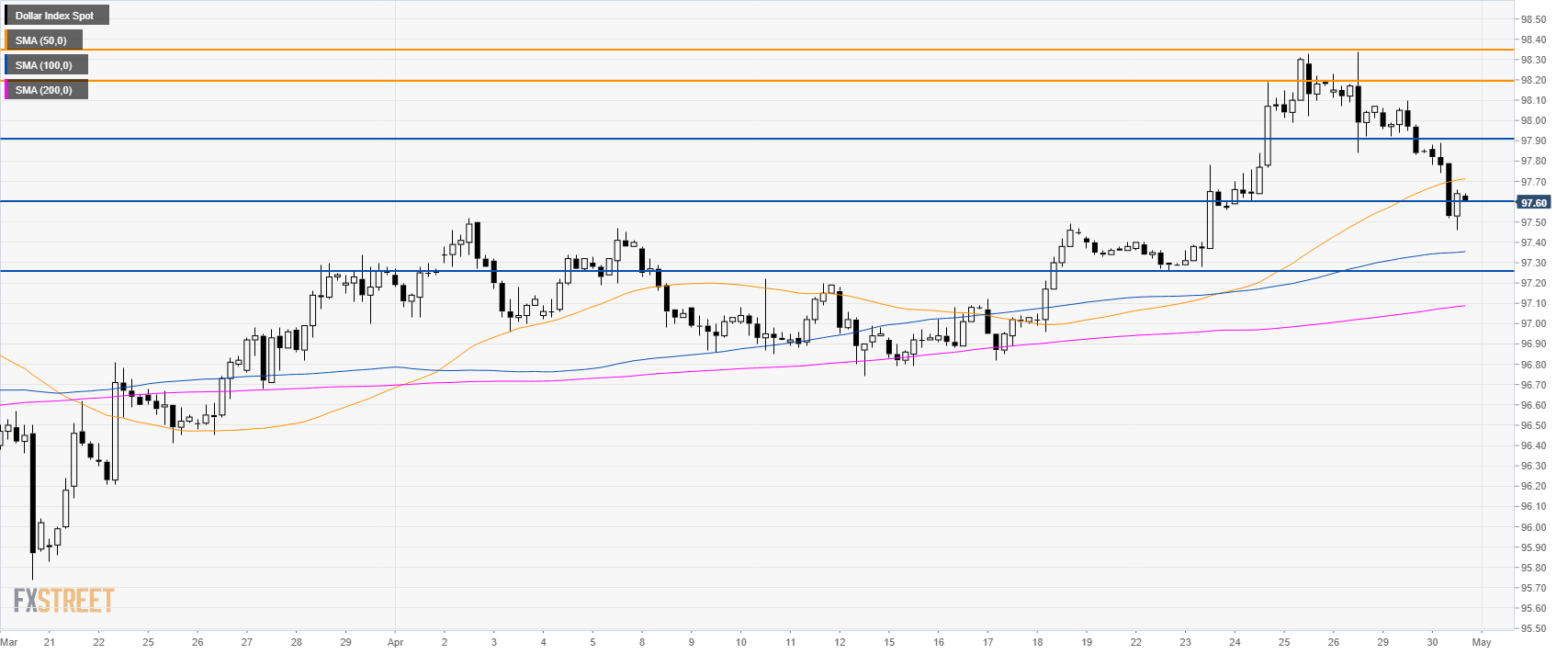

DXY 4-hour chart

- DXY is consolidating the recent losses below the 50 SMA.

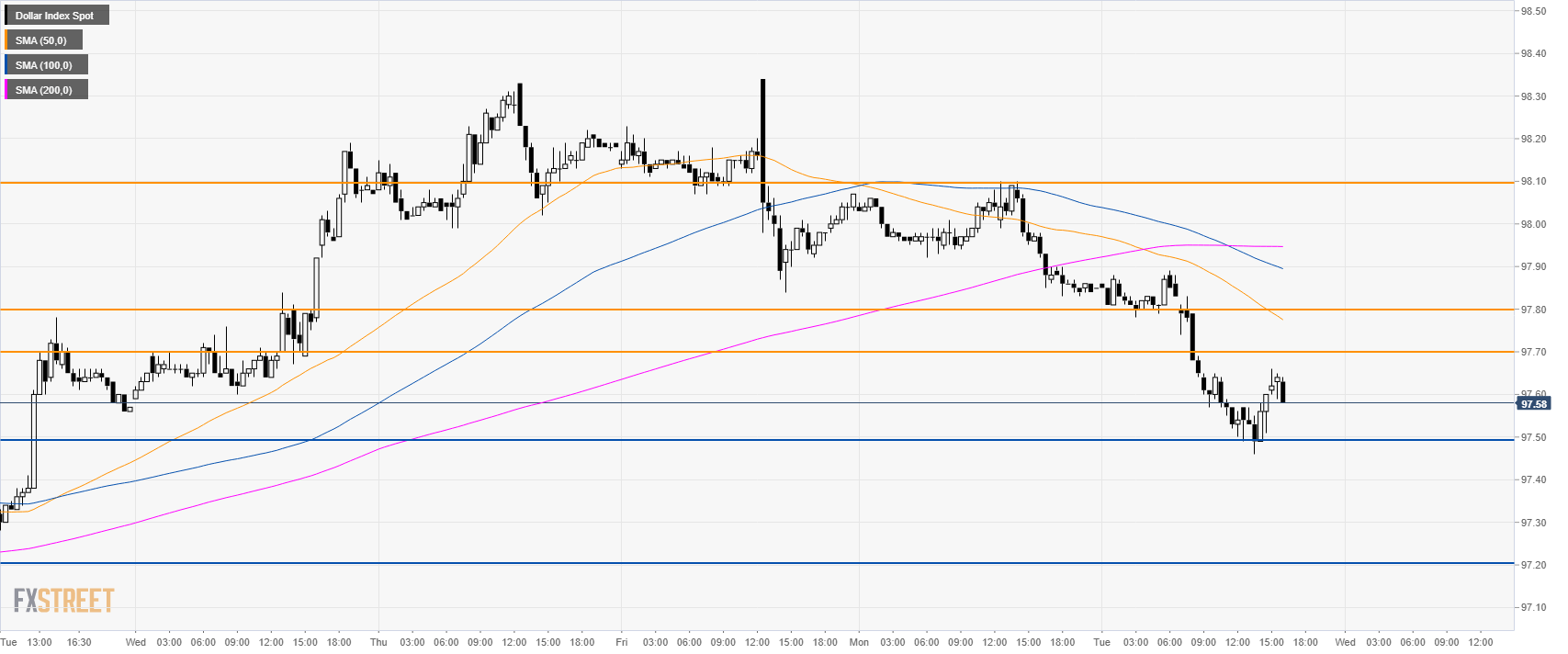

DXY 30-minute chart

- DXY is trading below its main SMAs suggesting a bearish bias in the short-term.

- DXY is having a small rebound at the 97.50 level but it remains to be seen if bulls can sustain prices above 97.70/80 resistances. A break above those levels can open the gates to more gains to 98.10 level.

- A slide below 97.50 would be seen as bearish and can lead to 97.20 to the downside.

Additional key levels