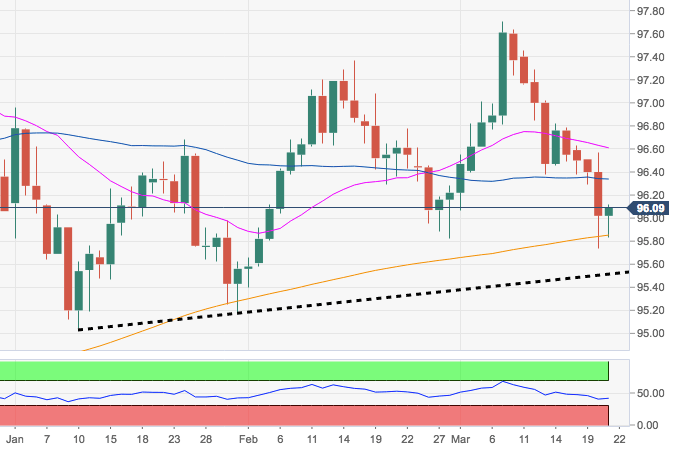

- DXY is seeing some light at the end of the tunnel following the sharp Fed-induced sell-off to the vicinity of 95.70 on Wednesday, around the key 200-day SMA.

- A breach of this area of support should allow for a retracement to 95.16, late January low.

- On the broader picture, the greenback’s stance still appears constructive while above the short-term support line, today at 95.51.

DXY daily chart