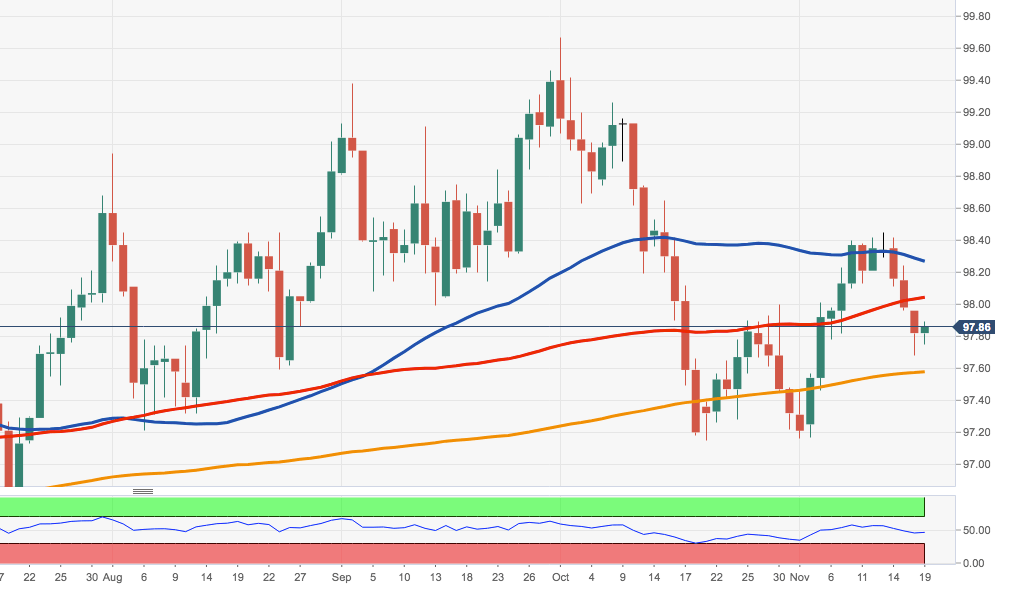

- The correction lower in the appears to have met decent contention in the 97.70/65 band, or fresh 2-week lows, so far.

- Any attempt of recovery should initially target the key 100-day SMA in the 98.00 neighbourhood ahead of the 55-day SMA, today at 98.25 and ahead of last week’s tops in the mid-98.00s.

- If the selling impetus gathers traction, the next support is located at weekly lows in the 97.70/65 band ahead of the critical 200-day SMA at 97.55. As long as this area holds, the constructive view on the buck is expected to remain unchanged.

DXY daily chart