- DXY extends the downside to multi-week lows near 92.20.

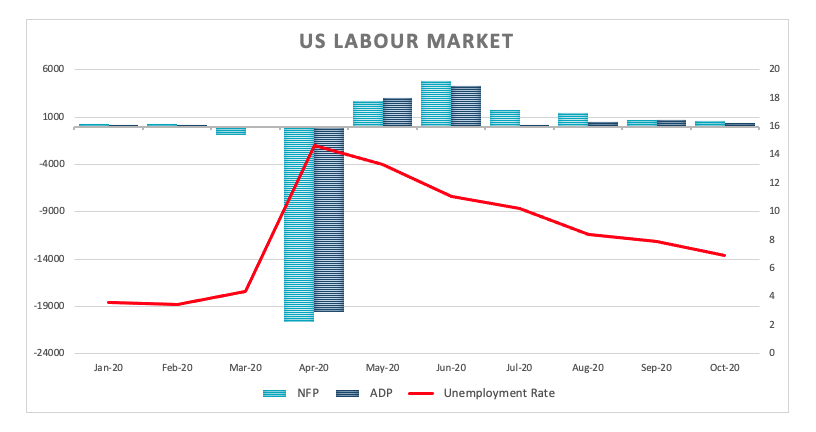

- US Nonfarm Payrolls came in at 638K in October.

- US unemployment rate ticked lower to 6.9% (from 7.9%).

The greenback remains immersed into a sea of red and trades in fresh 2-month lows in the 92.20 region when tracked by the US Dollar Index (DXY).

US Dollar Index looks to US elections

The index trades well on the defensive for yet another session, although it manages to bounce off multi-week lows in the 92.25/20 band against the backdrop of the broad-based solid sentiment in the global markets.

Indeed, the dollar exacerbates its downside in response to markets’ perception that Democrat candidate Joe Biden could win the US elections. So far, Biden remains on the lead with 253 electoral votes and according to latest news he is also winning the key states of Georgia and Pennsylvania.

In the US data universe, the always-critical Nonfarm Payrolls showed the economy added 638K jobs during October and the jobless rate ticked lower to 6.9%.

What to look for around USD

The index tumbles further and navigates 2-month lows around 92.20 amidst increasing improvement in the risk-associated universe. In the meantime, rising probability of a Biden presidency keeps weighing on the dollar, although prospects of a “blue wave” looks largely diminished by now. On the more macro view, the impact of the second wave of the pandemic on the global economy could favour the occasional re-emergence of the risk aversion and therefore lend some support to the buck. No news from the Fed leaves the “lower for longer” stance unaltered, while very near-term fireworks remain on the table in light of the release of October’s Payrolls.

US Dollar Index relevant levels

At the moment, the index is losing 0.16% at 92.37 and faces immediate contention at 92.22 (monthly low Nov.6) followed by 91.92 (23.6% Fibo of the 2017-2018 drop) and then 91.80 (monthly low May 2018). On the other hand, a breakout of 94.08 (100-day SMA) would open the door to 94.30 (monthly high Nov.3) and finally 94.74 (monthly high Sep.25).