- DXY moves lower to the proximity of 93.00.

- US Initial Claims rose to 714K during last week.

- ISM Manufacturing, Markit’s final PMI are due later.

The US Dollar Index (DXY), which gauges the greenback vs. a basket of its main rivals, remains on the defensive and closer to the key support at 93.00 the figure.

US Dollar Index offered on lower yields

The index loses ground for the second consecutive day on Thursday, reflecting the loss of upside momentum in US yields. Indeed, yields of the key US 10-year note deflate to the sub-1.70% area following recent tops near 1.80%.

In addition, the better mood surrounding the risk-associated assets is also weighing on the buck and dragging the index lower.

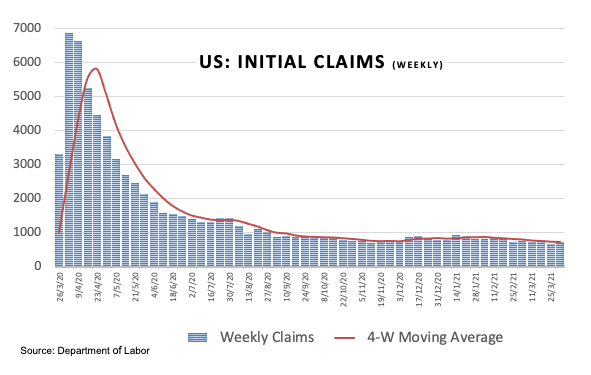

In the US data space, Initial Claims unexpectedly rose to 719K from a week earlier and Challenger Job Cuts shrunk more than 86% on the year to March to 30.603K.

Later in the NA session, Markit will release the final manufacturing PMI for the month of March ahead of the key ISM Manufacturing.

What to look for around USD

The upside momentum in the dollar looks well and sound for the time being. Supporting this idea, the recent breakout of the 200-day SMA seems to bolster the now constructive view on the buck, at least in the near-term. In addition, the recently approved fiscal stimulus package adds to the ongoing outperformance of the US economy narrative as well as the investors’ perception of higher inflation in the next months, all morphing into extra oxygen for the buck. However, the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made) and hopes of a strong global economic recovery (now postponed to later in the year) remain a source of support for the risk complex and carry the potential to curtail the upside momentum in the dollar in the longer run.

Key events in the US this week: Initial Claims, ISM Manufacturing (Thursday) – Nonfarm Payrolls (Friday).

Eminent issues on the back boiler: Biden’s new stimulus bill worth around $3 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is losing 0.24% at 93.01 and faces the next support at 92.48 (200-day SMA) followed by 91.30 (weekly low Mar.18) and then 91.29 (50-day SMA). On the other hand, a break above 93.43 (2021 high Mar.31) would expose 94.00 (round level) and finally 94.30 (monthly high Nov.4).