- The index alternates gains with losses around 94.60 on Monday.

- US 10-year yields flirting with lows near 2.87%.

- US New Home Sales coming up next in the docket.

The greenback, tracked by the US Dollar Index (DXY), is looking to gather some upside traction at the beginning of the week around the 94.50/60.

US Dollar looks to data, trade

The index manages to return to the positive territory on Monday, reverting at the same time two consecutive daily pullbacks amidst a selling bias in the risk-associated space and renewed jitters on the US-China/EU trade disputes.

In fact, absent relevant publications in both sides of the Atlantic during most of the week, investors remain wary on the trade front, where the US, China and the European Union are in centre stage.

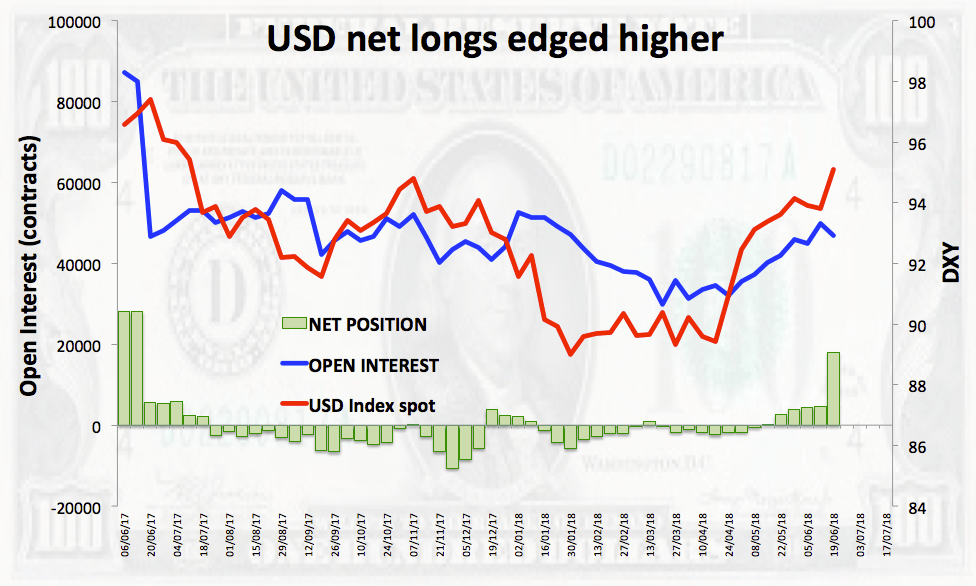

On the positioning front, USD speculative net longs climbed to the highest level since mid-June 2017 during the week ended on June 19, as per the latest CFTC report.

In the data space, May’s New Home Sales will be the sole release later today in the NA session.

US Dollar relevant levels

As of writing the index is up 0.01% at 94.55 facing the next resistance at 95.53 (2018 high Jun.22) seconded by 96.00 (psychological level) and finally 96.51 (high Jul.4 2017). On the other hand, a breach of 94.47 (low Jun.22) would open the door to 94.25 (21-day sma) and then 93.19 (low Jun.13).