Technical Bias: Bearish

Key Takeaways

“¢ US dollar dives as the fed stay away from an early rate hike.

“¢ USDJPY is struggling to hold an important bullish trend line.

“¢ USDJPY support seen at 101.80 and resistance ahead at 102.12.

The US dollar traded lower against most of its counterparts, including the Japanese yen after the fed interest rate decision, which sidelined the possibility of an early rate hike.

Technical Analysis

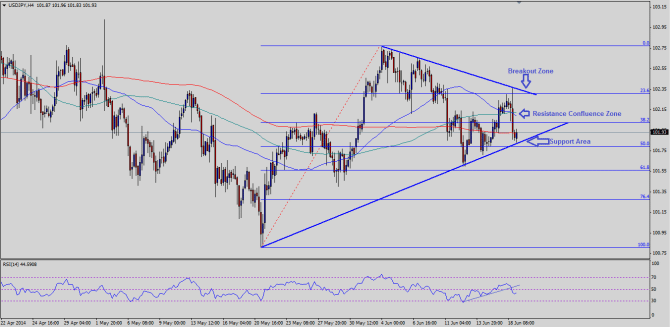

There is a critical contracting triangle forming on the 4 hour timeframe for the USDJPY pair. The pair after the fed interest rate decision climbed towards the triangle resistance trend line at 102.35, but failed to break the same and moved back lower. Currently, the pair is trading around the triangle support trend line at 101.90, which is holding the downside as of now. However, an important thing to note here is that there is a major divergence on the RSI. There was a crucial RSI trend line, which was broken earlier during the day. This suggests that the pair might also follow and break the triangle trend line moving ahead. If it breaks down, then a test of the 61.8% Fibonacci retracement level of the last major move from the 100.80 low to 102.77 high at 101.55 is possible in the short term. If sellers gain momentum, then the pair might fall towards the previous low of 101.55.

Alternatively, if the USDJPY pair bounces from the current levels, then it might find sellers around a critical resistance confluence zone of 50 and 100 simple moving averages (4H).

US Initial Jobless Claims

Later during the day, the US initial jobless claims data will be published by the Department of Labor. The forecast is slated for a 3K decline from the previous week’s reading of 317K to 314K. Moreover, the Philadelphia Federal Reserve Manufacturing Index will also be released, which is expected to fall from 15.4 to 14.0. Both these events are not expected to move the market much, but if the US jobless claims rise more than expected, then we might witness dollar selling later during the NY session.

Overall, there is a possibility that the pair might break the triangle and move lower as the RSI divergence might come into play.