Any strength of the US dollar seems to be short-lived. And the common currency is always there to take advantage of this. Even though EUR/USD is unable to break to new highs, it does not fall either.

The most recent downer of the dollar came from an important indicator: durable goods orders. After a week without any key figures, durable orders are already in the first line.

Headline orders dropped by 1.1%, worse than a slide of 0.5% expected. This may have been influenced by some one-off factors. However, core orders also fell short of expectations by rising by a modest 0.1%, under +0.4% predicted.

Orders of durable goods feed into GDP. In this case, these are the figures for May, deep into Q2. For those expecting a recovery in the second quarter, this is yet another reason to frown. Later this week, we will get the final GDP numbers for Q1. In the second release, they were upgraded from 0.7% to 1.2%.

Later this week, we will get the final GDP numbers for Q1. In the second release, they were upgraded from 0.7% to 1.2%. These numbers are annualized, meaning that quarter over quarter, the economy grew by only 0.3%. No change is expected.

More: EUR/USD: In A Range But Still Looking For A Final Dip Over The Summer – Danske

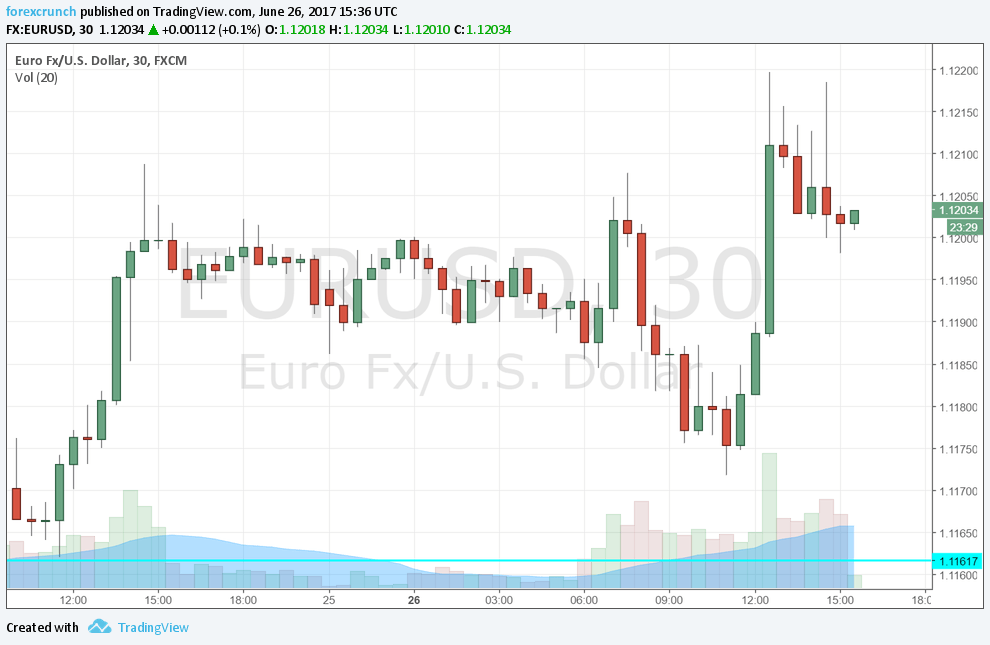

EUR/USD drifting upwards

Euro/dollar took advantage of the figures, topping 1.12. The pair failed to break resistance at 1.13 but also could not drop below 1.11. It is now in the middle of the range.

At current levels, support awaits at 1.1160. The next support line is 1.11. On the way up, resistance is at 1.1240, followed by 1.13, the ultra-strong cap.