Durable goods orders fell by 1.2%, much worse than +0.3% expected. A small upwards revision worth 0.2% is not enough to compensate. Core orders rose by 0.4%, also below expectations, but the revision here is more significant: 1.1% against 0.7% originally reported. Orders excluding defense and air fall by 0.5% instead of a rise of the same scale. Also here we had an upwards revision for September, but it is far from compensating for the big fall.

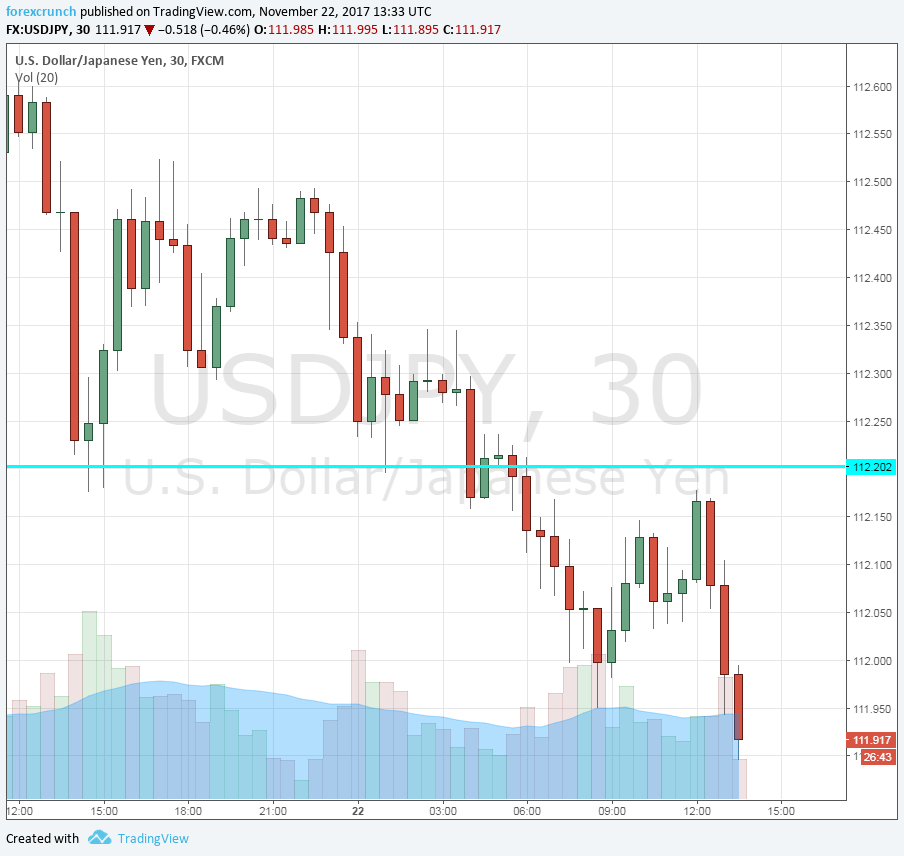

The US dollar ticks down a few pips but does not go anywhere fast. Here is the USD/JPY chart:

Durable goods orders were expected to rise by 0.3% in October after a jump of 2% in September (before revisions). Core orders carried expectations for a rise of 0.4% against 0.7% recorded in September.

We also get the weekly report about jobless claims which were predicted to stand at 241K against 249K last week. This is an early release due to the Thanksgiving holiday tomorrow.

The US dollar was somewhat weaker ahead of the release, most notably against the yen. USD/JPY was flirting with 112, down some 40 pips on the day.

Later today, we will get a revision of consumer sentiment for November. More importantly, the Fed releases its meeting minutes for the November meeting. It is important to remember that this document is revised until the last moment and is not necessarily a full reflection of what happened three weeks ago.

Fed Chair Janet Yellen said that lower may not be transitory. This is a shift from her previous stance. The FOMC is becoming more worried.