Some say that the US elections campaigns begin in earnest only after Labor Day. That is when Americans return from a long week that marks the end of summer. It is also the time when traders who have been on vacations are all back to their desks.

So far, many have followed the fascinating primaries, conventions, and campaigns in general, but it is hard to say we have seen any significant effect on financial markets. There are some reasons to believe it will change now.

Elections back in the spotlight

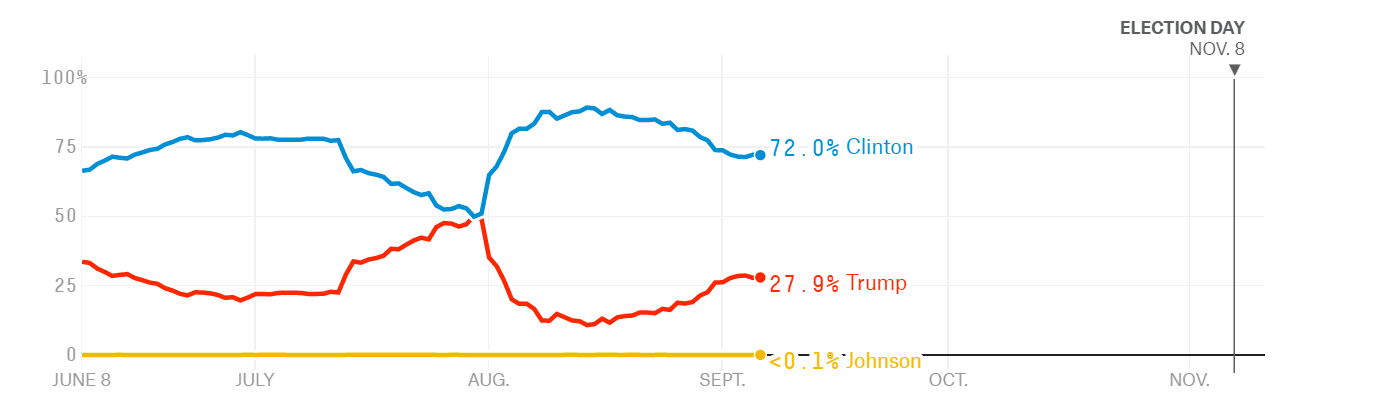

The end-of-summer mentioned above is one reason which applies to every cycle. This particular period has its characteristics. As the title already laid it out, the polls are tightening. Clinton was in the lead back in June before the race tightened around the RNC in early July. And then, the successful DNC and more importantly Trump’s losing streak of gaffes sent Clinton to near double-digit leads.

After the dramas of July, the shakeup in Trump’s senior campaign staff, as well as the ongoing issues Clinton has with her emails, are having some results. It isn’t dramatic as the shifts seen beforehand, but Clinton’s lead is certainly eroding.

According to the Nate Silver’s highly regarded FiveThirtyEight website, the chances gradually dropped from nearly 90% to just above 70%. The national lead is around 4.5%, which is the margin of error in some polls. Also, there is a higher number of undecideds and voters for third party candidates such as Gary Johnson and Jill Stein. All in all, the level of uncertainty is far greater than in 2012. Back then, Obama had a smaller but much more confident lead over Romney.

Clinton Continuation Preferred

For financial markets, this uncertainty joins other worries: will the Fed raise rates or not? What does Brexit mean? How hard or soft is China’s landing? Will OPEC and non-OPEC countries reach a deal on cutting oil production?

Financial markets usually prefer Republican candidates as in theory they promote free markets and business-friendly policies. This time is different: Trump’s isolationist anti-trade stance and his contradictory statements about more-or-less everything scare many market participants. On the other hand, Clinton is “the devil you know”, providing continuity. Markets are used to a Democrat President alongside a Republican Congress.

Trumped Markets

What does this uncertainty mean for foreign exchange markets? The Japanese yen is the ultimate safe haven currency. After a ride to the upside, USD/JPY could possibly turn south on a negative market reaction to the tighter polls.

Commodity currencies, AUD, NZD, and CAD, could reverse their post-NFP gains. While the Fed is not set to raise rates, the fiscal side could become more worrying than the monetary one.

More:

And: what the elections mean for currencies: