The euro has rallied against the dollar on optimism for a deal on Greece. The common currency also carried along a few of its peers.

And now, the USD sell off got another boost from a poor read: factory orders dropped 0.4%. They were expected to remain flat after jumping 2.2% in March (revised up from +2.1%).

Adding fuel to the fire, also the IBD/TIPP Economic Optimism indicator disappointed with a slide from 49.7 to 48.1 points. This is below expectations.

It is important to note that both these US indicators are not top tier numbers: nevertheless, they just exacerbate the greenback’s situation.

Greek deal?

The June 5th deadline is getting closer: that’s when Greece needs to pay money to the IMF, and there isn’t too much money at hand. The Greek side has been optimistic along the way, while cold water has been poured by the other side.

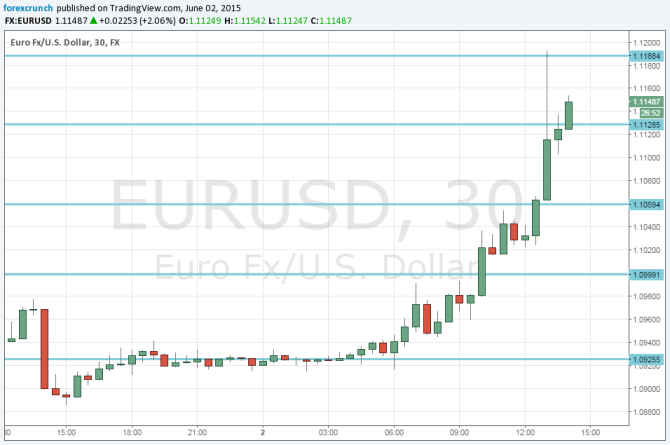

Nevertheless, there are signs that a deal is getting closer and close and this sent EUR/USD above 1.10.

And when the level was breached, stops were triggered and this made the move a bit more exaggerated: EUR/USD reached a high of 1.1192, before it fell to current levels.

But this may be only temporary towards the ECB. Join us for a webinar on the ECB and the NFP.

Is this the end of the euro’s falls for the year? Maybe and maybe not. Here is another opinion: EUR/USD Still On Track To Break Below Parity – BTMU

Here is how today’s big rally looks on the chart.

In our latest podcast, we discuss commodity currencies, oil hedging and preview next week’s events.