- The first revision to second-quarter GDP is set to show a minor upgrade.

- Several upside surprises in US figures indicate a better result.

- On the other hand, coronavirus’ resurgence in June may result in worse data.

Confirming the catastrophe, albeit with a marginal upgrade – that is what economists are expecting for the revised Gross Domestic Product data for the second quarter. There are reasons to expect it could go both ways

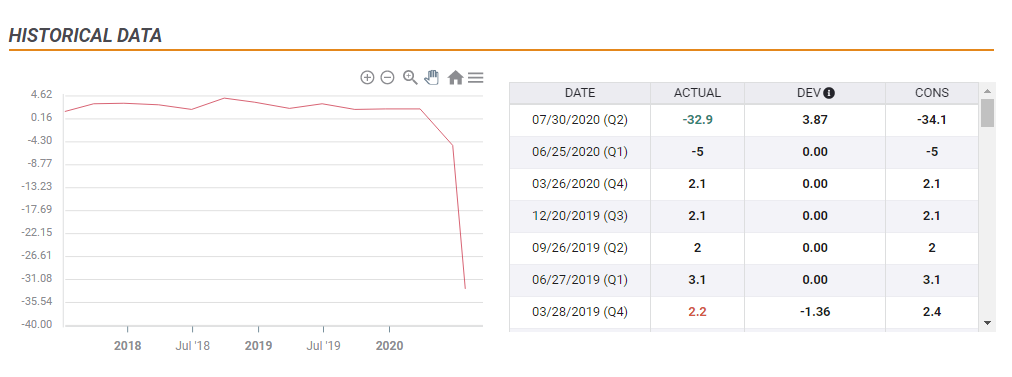

The brunt of the coronavirus crisis was felt in the three months ending in June – an annualized drop of 32.9% according to the first read after slipping by around 5% in the first quarter. The consensus stands at a minor upward revision to -32.6% now.

One of the reasons for an improvement in last quarter’s figures comes from revisions to the upside for underlying figures. For example, the increase in June’s retail sales was pushed from 7.5% to 8.4% in the latest report.

Another factor to consider is that several other US economic indicators beat estimates – whether related to the second quarter or not. The most recent example is Existing Home Sales which smashed estimates with a jump of 24.7% to 5.86 million annualized in July.

Overall, the US economy has fared better than gloomy forecasts with economists probably underestimating the impact of massive fiscal stimulus. While government support expired in late July, there is a case for an improvement in the updated figures for the second quarter.

On the other hand, America’s coronavirus situation began deteriorating late in the quarter – deterring shoppers from going out and about even before new restrictions were imposed. The second estimate of GDP leans more on figures released for late in the quarter rather than the initial part.

Rising COVID-19 cases in June, make the case for a worse outcome.

Potential market reactions

If the upbeat narrative prevails and annualized GDP is revised up – especially to above -30% – would support the dollar. A softer crash means a higher base to recover from and a reduced need for stimulus by the Federal Reserve.

A downbeat figure – due to coronavirus or any other reason – would send the dollar down amid expectations for additional Fed stimulus.

Jerome Powell, Chairman of the Federal Reserve, is due to speak at the virtual Jackson Hole Symposium shortly after the figures are released. He will have received the statistics while preparing his remarks, and they may impact his tone.

In case GDP statistics come within estimates, investors may focus on weekly jobless claims that are published at the same time. After falling below one million, initial applications bounced above that round number, causing concern. Another significant surprise in unemployment claims – whether to the upside or the downside – may steal the show from GDP data.

Conclusion

Economists expect a marginally upward revision to the worst GDP read in history and probably base their assessment on upward revisions and previous upside surprises. The resurgence of the virus could cause a downside surprise. The dollar is set to react to the data within the context of jobless claims and Powell’s speech.