US data is better than expected: the employment cost index rose 0.7% in Q1, better than 0.6% predicted. Year over year, it is +2.6%, the highest since the crisis. Jobless claims made a remarkable drop to 262K, the best in a very long time. A disappointment comes from Core PCE: it falls to 1.3% y/y from 1.4% beforehand.

The US is gaining some ground — more coming

The US released a big bulk of data. The key figures are: employment cost index index which was expected to rise 0.6% in Q1 (but the Fed may have hinted it could be better) and the Core PCE price index which stood on 1.4% y/y. These are the key figures for the Fed.

The US dollar managed to stage some kind of recovery against commodity currencies while continuing to suffer against the euro (1.12 before the release) and the pound (1.5422)

The data

- Employment Cost Index: exp. +0.6% q/q, above 2% y/y. The actual number is +0.7%, with wages up 0.7%, better than 0.6% beforehand.

- Core PCE Price Index: exp. ++0.2% m/m after +0.1% last time. Year over year, last was 1.4%. The actual numbers are a miss: +0.1% m/m, +1.3% y/y.

- Jobless claims that carried predictions of 290K after 295K last week. The actual number is 262K. This is a huge beat and the lowest since December 2000. The 4 week moving average slides to 283.75K.

- Personal Spending: Exp. +0.6% m/m. The actual number is 0.4%.

- Personal Income: +0.2% m/m. The actual figure is a disappointment: 0%.

- Continued claims stand at 2.25 million, which is also a great improvement.

Currency reaction

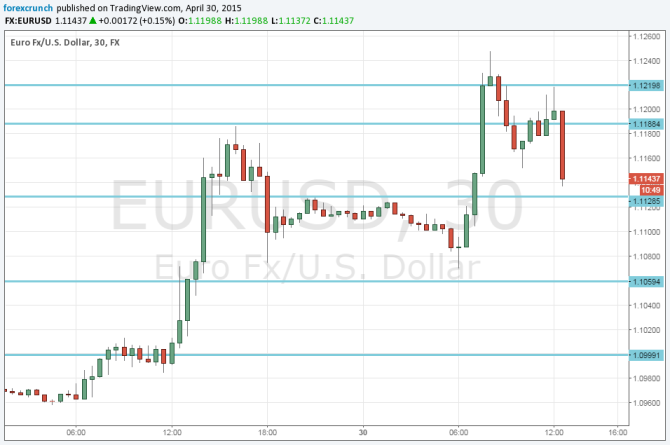

- EUR/USD dropped from 1.12 to 1.1160. It seemed strong throughout the day.

- GBP/USD has slipped below 1.54 to 1.5380.

- USD/JPY is above 119 with 119.15.

- USD/CAD is around 1.2033, higher, despite a good GDP number from Canada.

- AUD/USD is hanging around 0.79.

- NZD/USD is slipping below 0.76.

Background

The dollar received a big blow from the terrible GDP report from the US: an annualized growth rate of only 0.2%. This sent EUR/USD above the critical 1.1050 level and also affected other pairs.

But then came the Fed, which had the data in front of its eyes and basically saw Q1 weakness as “transitory”, with more optimism towards the future.

EUR/USD chart: