This Friday the all important US Non Farm Payrolls number is released for August and a strong number could be very bullish for the USD whilst hammering risk currencies and assets given the implications for US monetary policy.

Various polls of economists suggest NFP could come in around 180,000, compared with 162,000 in July, which was below forecasts for 182,000 and left USD bulls disappointed. This shows the number can be relatively unpredictable and is more than capable of delivering surprises.

By Justin Pugsley, Markets Analyst MahiFX Follow MahiFX on twitter

However, August was a good month for the US economy with various hiring surveys implying a positive trend and weekly unemployment benefits claims trended lower. So the run of good economic numbers from the US may start to drive faster employment creation, which is anyway a lagging indicator.

A number that surprises on the upside, say 200,000 or over, should see a higher USD against EUR, JPY and GBP and would be particularly bad news for many already struggling emerging market currencies suffering in anticipation of a winding down of US quantitative easing.

Friday should see big volatility burst

Strong jobs number likely to see start of Fed tapering

A strong number would also imply that the Fed will wind down its $85 billion a month purchasing programme soon, possibly even this month. However, given the relatively strong performance by USD of late, it is probably more vulnerable to a knee-jerk sell-off on a surprise weak number.

But even then USD weakness may only be short lived given the brewing Middle East crisis involving Syria. There are also a host of other potentially bullish, read risk aversion inducing, events for USD. These include the next round of haggling over the US budget deficit in October and of course the replacement of the current Fed chairman on January 1, 2014. A new Fed chairman always injects a certain amount of uncertainty while the markets get used to them.

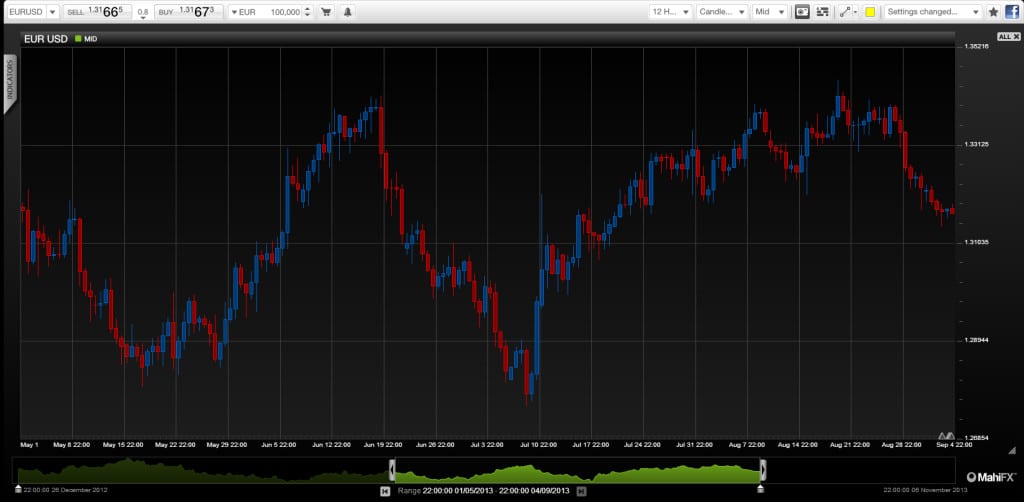

Upside targets for EUR/USD are around 1.3180, 1.3200, 1.3230 and 1.3240 and on the downside at 1.3130, 1.3100-1.3090, 1.3050 and 1.2990-1.3000.

Further reading: EUR/USD: Trading the US Non-Farm Payrolls