Sales of pending homes advanced 5.1% in April, better than a modest rise of 0.6% expected. While this may not be the most important indicator, not in absolute terms nor for the housing sector, this allows EUR/USD to slide back down in range.

Earlier, durable goods orders beat expectations on the headline and the core figures, but a measure of orders excluding defense and air was actually down. After the initial dollar upswing, the greenback turned south, with EUR/USD challenging the old resistance line of 1.1215. Now we turn south again.

The chances for a rate hike in June declined from around 34% to 28% after the durable goods release. While pending home sales will have little impact on the Fed’s decision, they provided an opportunity for profit taking and as a reminder that the USD probably remains the cleanest shirt in the dirty pile: there is an ECB meeting next week.

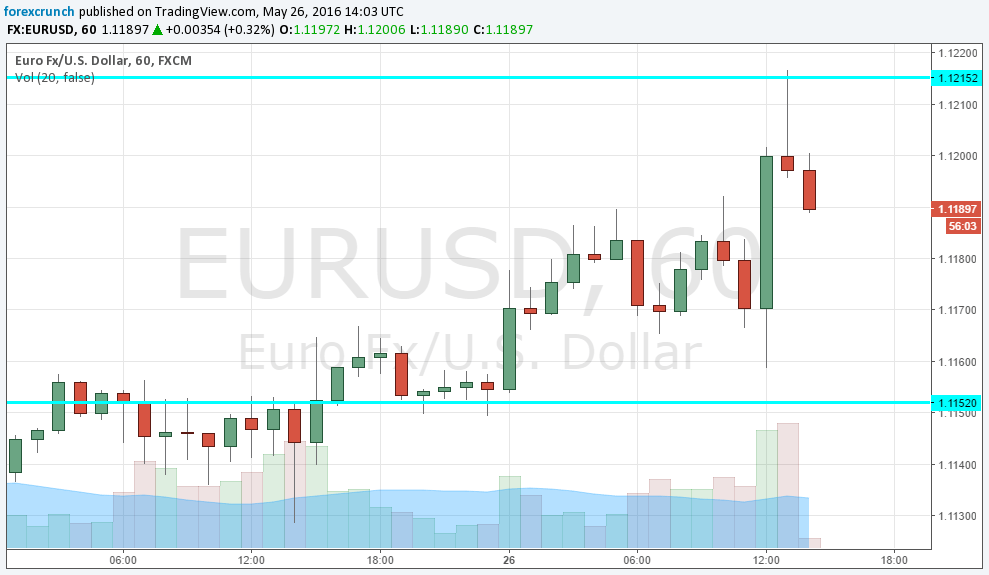

Support awaits at 1.1180, followed by 1.1130 and 1.1070. Further resistance above 1.1215 is at 1.1250. Here is the one hour chart: