After the close, US President Donald Trump said if there is a second wave, he will not close down the economy.

Will not close the country if a second wave of virus hits.

Market implications

That is big news. Shame it wasn’t said during the Wall Street session, as the reaction could have been volatile.

On one hand, it could have supported risk appetite. On the other hand, it may have sent a shock wave through markets considering it seems that Trump has just admitted that a second wave is probable. At this juncture, it would seem that the US administration is willing to put hundreds of thousands of lives at risk for the sake of the US economy.

Will this mean workers will be forced into work against their will? There will be no government funding for those who do not want to work, that is for sure.

As per yesterday’s article, under, The next wave, “as governments tempt the fate of the second wave of COVID-19, through no choice of their own, the odds of such an outcome are seemingly high when considering there are already new cases in China, Russia and even South Korea which had been praised for its containment of the first wave:

As traders, we are inherently looking to the past for clues about what could occur in the future.

The influenza pandemic of 1918 (the Spanish Flu) had three major waves, starting in March 1918, its peak came during a second wave late that same year. The second wave was a stronger mutation than the first version of the virus and the U.S. Centers for Disease Control and Prevention (CDC) has said the second wave was responsible for the majority of the deaths in the US — the flu’s likely country of origin. It is also worth noting that a third wave came in early 1919 and lasted until mid-year when, according to the CDC, the Spanish flu subsided.

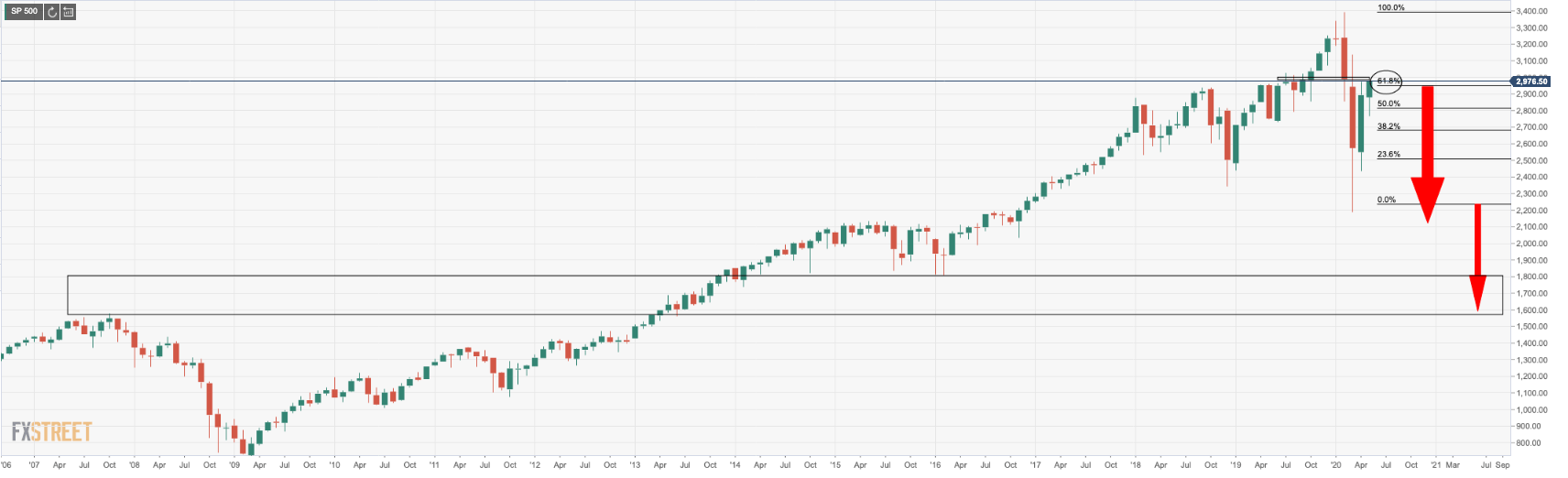

Either the markets are complacent, or the next financial market’s wipe-out is a foregone conclusion and it is only a matter of time until the tidal wave of COVID-19 hits our trading screens. We keep our eyes on the 5-year US Treasury yields and the 61.8% Fibonacci retracements in the US benchmarks.

With yields bobbing along with the lows, the closer to zero they get the more likely a financial depression will be the outcome.

With equity markets travelling on fumes, the 61.8% is the golden ratio where we would expect the top of the correction to solidify – if not, the 78.6% could be the bear’s last defence.