The upbeat durable goods orders for December did not help. US GDP was left unchanged at 1.9%. Consumer spending is up to 3% and the PCE and the deflator are moving up, so there are some silver linings. Sales are up 0.9% against 1% expected. The goods trade deficit widens to $69 billion.

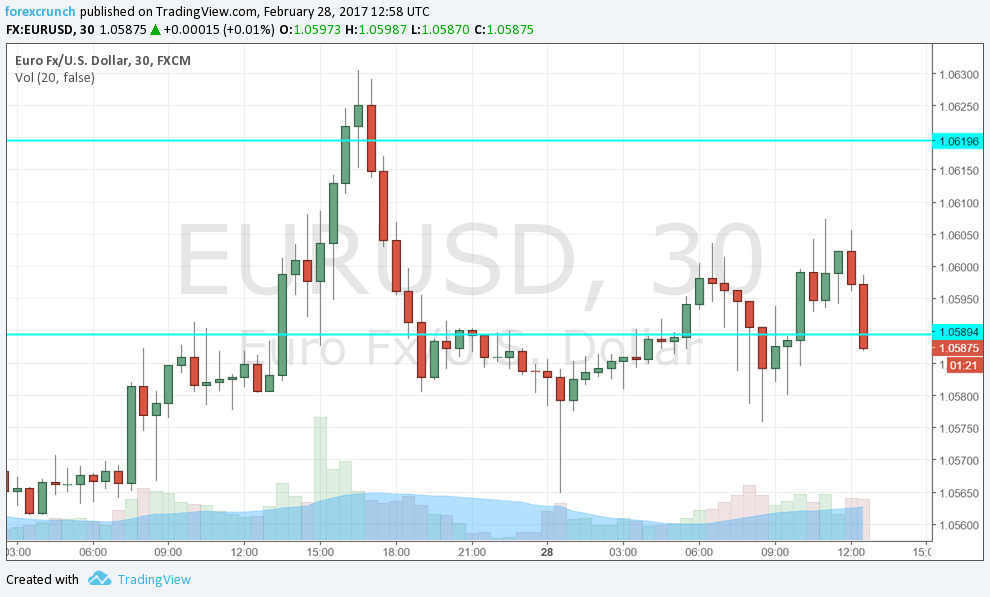

The US dollar is falling with EUR/USD topping 1.06. USD/JPY is flirting with the 112 line, the bottom of the range. GBP/USD is trading around 1.2433. USD/CAD is around 1.32, AUD/USD at 0.7675 and NZD/USD is at 0.7205.

The US was expected to revise the GDP read from 1.9% to 2.1% for Q4 2016. The figures are annualized. The type of growth also matters. Generally speaking: personal consumption and investment are considered “good growth” while government spending and inventories are “bad growth”. At the same time, the US goods trade balance was forecast to show a deficit of $66 billion.

Here is the preview: trading the US GDP with EUR/USD.

The US dollar was struggling ahead of the publication. On one, expectations for a rate hike in March are now higher according to the Bloomberg WIRP function. On the other hand, Trump’s Fox interview failed to stir markets. Here are three reasons for a Donald Disillusion.

Real expectations may have been even higher after yesterday’s durable goods orders revisions for December that feed into this output revision. While 2017 began with a disappointment for investment, 2016 seemed better.