Finally some good news from the US: retail sales beat expectations on all measures and all the revisions are to the upside. Headline sales advanced 1.3%, the control group by 0.9% and core sales by 0.8%, all are beat. Upwards revisions are between +0.1% to +0.3%.

The US dollar is extending its gains with no currency spared.

Update: also consumer sentiment beat expectations with a rise to 95.8 points, above 91 predicted. This is a winning streak for the US dollar. However, a rate hike in June remains a bit far, and the potential for a Brexit serves as one excuse.

US retail sales were expected to bounce back in April, with a rise of 0.8% in the headline number, 0.5% in core retail sales and +0.3% in the control group. This is a top tier release as consumption is a major part of the US economy. The figure mixed expectations too many times in the past year or so.

The US dollar was looking relatively solid towards the release.

Data (updated)

- Retail sales: previous -0.4%, exp. +0.8%, actual: 1.3%, prior revised to -0.3%.

- Core sales: prev. +0.1%, exp. +0.5%, actual: +0.8%, prior revised to +0.4%.

- Control group: prev. +0.1%, exp. +0.3%, actual: +0.9%, prior revised to +0.2%.

- Ex gas/autos: prev.+0.1%, actual: +0.6%, prior revised to +0.2%.

- PPI m/m: prev. -0.1%, exp. +0.3%, actual: +0.2%

- Core PPI m/m: prev. -0.1%, exp. +0.1%, actual: +0.1%.

- PPI y/y: prev. -0.1%, exp. +0.2%, actual: 0%

- Core PPI, y/y: prev. 1%, exp. 1%, actual: +0.9%

Big beats in retail sales and some misses in the PPI, which is easily overshadowed by the excellent sales data.

Currency reaction

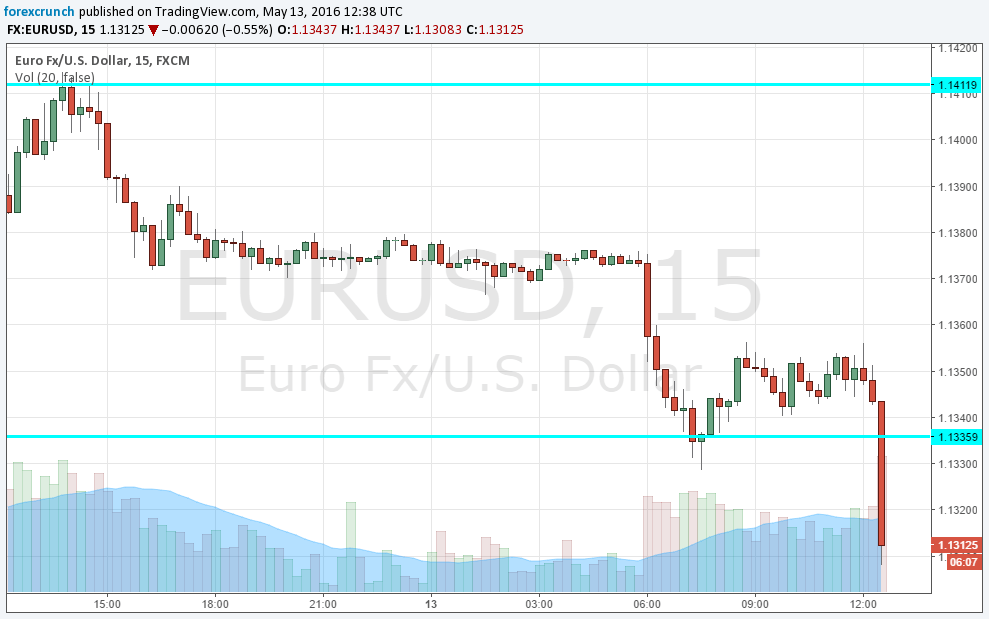

- EUR/USD traded around 1.1350, slipping despite good German GDP. The pair slips towards 1.13.

- GBP/USD was just above 1.44 after yesterday’s BOE Super Thursday. Cable dips under support at 1.4370.

- USD/JPY was in range, around 108.80 We are now back to 109.30, close to the double top at 109.40.

- USD/CAD was around 1.2880, rising a bit alongside the slide in oil. 1.2905 is the new level. US demand is also good for Canada.

- AUD/USD remained under pressure at 0.7280. The pair is slightly below this level,

- NZD/USD was stable at 0.68 after a miss on New Zealand retail sales. The pair is 20 pips lower.

All in all, major pairs are suffering more than commodity currencies.

More: Should we worry about US jobs?

Here is how it looks on the EUR/USD chart: