Good news all around from the US: retail sales beat expectations on all the figures and they all include upward revisions. The headline number advanced by 0.8%, better than 0.6% predicted and with an upwards revision for September from +0.6% to 1%. Core sales beat with 0.8% against 0.5% predicted and also here, on top of an upwards revision from 0.5% to 0.7%. The Control Group beat with +0.8%, much rosier than 0.3% projected and once again, the previous number was upgraded from 0.1% to 0.3%. Even the separate release of the NY Fed Manufacturing turned positive at 1.5 points, beating expectations for -2.5.

The USD is on the rise but is not going very far. The upside in the greenback could accelerate as the report is an absolute blockbuster. Consumption is fundamental to the US economy and could be decisive in determining a rate hike in December.

Retail Sales and Market Background

The US was expected to report an increase of 0.6% in the volume of retail sales in October, repeating September’s number (before revisions). Core sales were expected to rise by 0.5%, also a repeat and the retail control group by 0.3% after 0.1% last time. The New York Fed Manufacturing index was projected to rise from -6.8 to -2.5 points.

The US dollar has resumed its uptrend after it corrected earlier. Here are the reasons for the dollar’s rise. Basically, markets expect Trump to spend, spend and spend, raising inflation and triggering rate hikes.

Tomorrow we get PPI and industrial output. On Thursday, things are even busier with CPI, the Philly Fed Manufacturing Index and the weekly jobless claims.

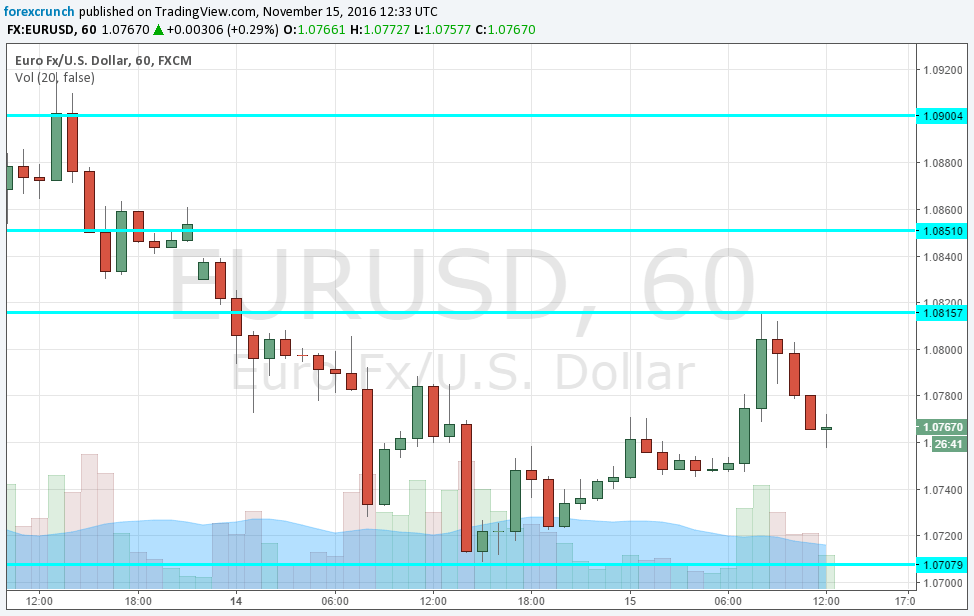

EUR/USD demonstrated perfect range trading in recent days. After making a move to the upside, it dropped once again.