The US dollar had quite a few negative weeks, mostly due to dovishness coming out of the Fed, and in particular from Chair Yellen. Nevertheless, the data-dependent Fed may have reasons to look a bit more optimistic, and this could support the greenback:

Here is their view, courtesy of eFXnews:

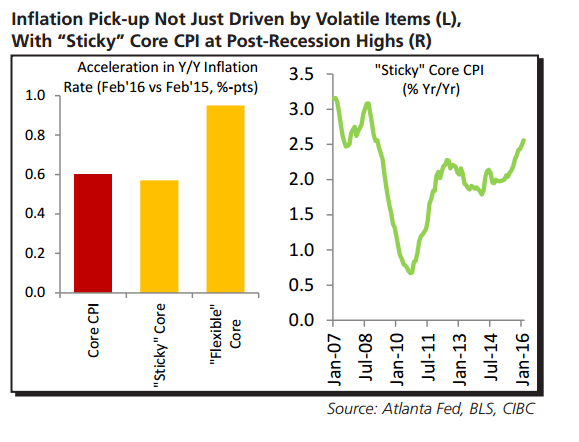

Chair Yellen mentioned it, and a majority of FOMC members appeared to agree that the acceleration in US core inflation was largely due to more volatile items.

However, while that may be the case at the margin, it fails to make note that even measures of inflation that exclude volatile items have also moved up in the past year. And in some cases they’re not just moving higher.

The Atlanta Fed’s “sticky” measure of core CPI, which only uses components with low volatility, has reached its highest level since the recession and is in touching distance of pre-crisis norms.

If the strengthening in core inflation proves more persistent than FOMC members currently believe, the Fed will turn more firmly towards a June hike which will see the US$ recover some recent lost ground.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.