The US dollar had an impressive “Turnaround Tuesday” and managed to beat its rivals. The team at Goldman Sachs sees more gains ahead, and eyes one specific pair.

Here is their view, courtesy of eFXnews:

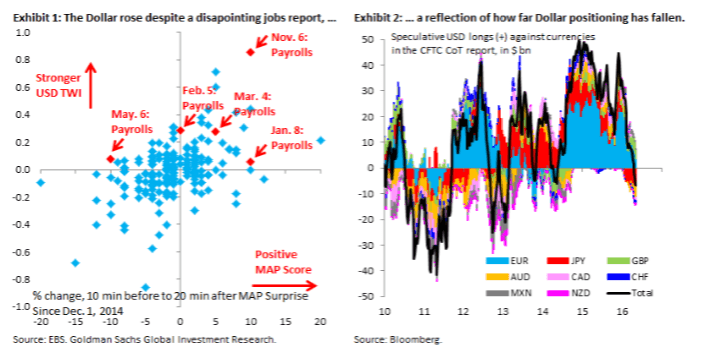

Last week’s disappointment on payrolls offers an important insight on positioning. As Exhibit 1 shows, even though the data were a material disappointment – they registered -10 on our proprietary MAP score (horizontal axis) – the Dollar rose marginally in the minutes after the release (vertical axis), a testament to just how low expectations have fallen with respect to US growth and the Fed. This corroborates the CFTC’s Commitment of Traders report, which shows that short Dollar positioning is now the most sizeable since early-2013 (Exhibit 2).

It is fairly clear therefore that – from the perspective of the Fed – the Dollar has reached a bottom. But, in a way, the Fed has been something of a sideshow for the Dollar recently. After all, it was the decision by the BoJ not to take action last month that set in motion that last round of Dollar weakening. The market saw the BoJ’s move to negative interest rates in January as validating concerns that there are limits to aggressive QQE and interpreted the lack of action in April as further evidence in that regard.

The Yen and the Euro strengthened sharply, giving rise to the latest round of Dollar weakening. Our view is that there is ample space for the BoJ to pursue aggressive balance sheet expansion. We think concerns over JGB scarcity are overblown, in particular since the BoJ can still anchor yields in the extreme case where it has bought all outstanding supply. There is also scope for purchases to include housing loans, a possibility Governor Kuroda floated in a speech some weeks ago. Most important, though, we still have faith that the BoJ is willing to surprise markets in a dovish way, which is the cornerstone of monetary policy at the zero lower bound.

We therefore see $/JPY as our highest conviction view on a 3- to 6-month horizon. We do not have the same conviction with respect to EUR/$ downside. The ECB has now disappointed markets twice. While it is obviously not the objective of monetary policy to fulfil market expectations, we see the inability of the ECB to ease in an effective manner as signalling more fundamental disagreement over the path of policy within the institution. It is clear that inflation is running way below the ECB’s forecast of 1.1 percent for core HICP this year. But, unfortunately, it looks like inflation will need to go lower before effective easing comes back on the agenda.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.