The dollar had a good 2014, running strong across the board as the Fed unwinds stimulus. Are we set for a correction in 2015 or can the dollar continue running long?

Alvise Marino & Anezka Christovova of Credit Suisse weigh in:

Here is their view, courtesy of eFXnews:

“We project a roughly 5% DXY appreciation over the next year. This is driven by our expectations of rate spreads widening in USD’s favor above and beyond what’s already in the price. Our economists call for 100bps of hikes from the Fed in 2015 while other major central banks, such as the ECB, are likely to still ease.

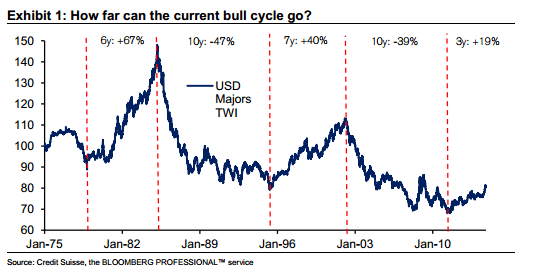

If we take the low in 2011 as the start of the current bull cycle, the USD has already risen more than 20% in DXY or USD Majors TWI terms. The previous two bull cycles resulted in a sizeable USD appreciation – close to 70% from 1978 to 1985 and 40% from 1995 to 2002.How much further can the current cycle run?

…While we see limited obstacles to near-term USD strength from a flow (balance of payments) perspective, we think the stock impact of a stronger USD on the net international position could result in USD negative pressure down the line. This can act as a natural cap on the USD’s ability to rally leaving this bull cycle potentially less impressive than the previous two.”

Alvise Marino & Anezka Christovova – Credit Suisse

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.