The Fed certainly showed its dovish side, with the dot chart pointing to a slower if not delayed rate hike path.

The team at HSBC suspects this may be the beginning of the end of the USD rally and examines:

Here is their view, courtesy of eFXnews:

In a special note to clients today, HSBC warns that the USD rally is nearing its end.

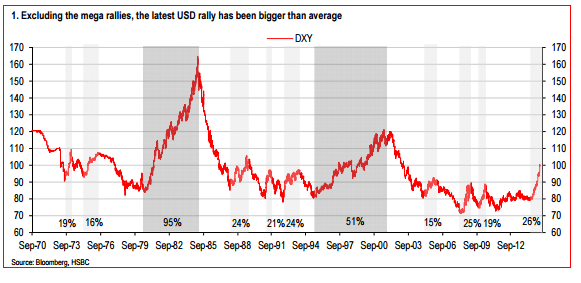

“This is in contrast to a market which appears determined to envisage ever greater upside for the currency. The USD has already rallied more than is typical historically, and many of the arguments currently being used to justify an extension are likely already in the price,” HSBC adds.

Having been one of the early adopters of a bullish USD view back in 2013, HSBC now sees factors that make them believe we are at the beginning of the end:

These factors, according to HSBC, are “recent data developments -US tolerance for USD strength has its limits -Valuations -Positioning / USD bullishness has become all-pervasive -USD does not perform once Fed has actually pulled the trigger.”

“There is obviously scope for one last spike higher, as is often the case in the later phase of big bear or bull market moves, which sucks all participants into the narrative. So convinced become the participants that any rational arguments fall on deaf ears and forecasters start coming out with ever more extreme views,” HSBC argues.

“But it is time to start looking the other way as this last spike is likely to be reversed swiftly. When the world seems to be revising EUR-USD expectations ever lower, we are moving the opposite way. Our forecast for year-end 2016 is now 1.10 compared to 1.05 previously, and we believe the rate will move to 1.20 during 2017,” HSBC projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.