- USD/CAD is correcting from the BoC induced lows and eyes are on a downside extension.

- BoC tapering earlier than expected is a bullish catalyst for the commodities complex.

USD/CAD is trading at 1.2502 and flat at the start of Asia following a big turnaround day with the Bank of Canada (BoC) cutting its weekly bond purchases by 25% to C$3bn.

The BoC, however, held its key overnight rate steady at 0.25%.

USD/CAD dropped from a high of 1.2653 to a low of 1.2459 before ending the day at 1.2495.

The BoC’s decision was made due to the improvement in economic activity noting that “as vaccines roll out and the economy reopens, consumption is expected to rebound strongly in the second half of this year and remain robust over the projection.”

The BoC said it now expects economic slack to be absorbed in the second half of 2022, from a previous forecast of into 2023.

Governor Tiff Macklem said that the bank is committed to refrain from raising rates until the economy is running at full capacity and that there is no guarantee borrowing costs will rise when those conditions are met.

“What we do when those conditions are met, we’ll have to assess that at the time. There’s nothing mechanical,” he said, adding: “We’re looking for a full recovery, we’re not going to count our chickens before they’re hatched.”

The BoC believes the pandemic will be “less detrimental” than previously assessed to the economy’s potential output, giving the nod to a rate hike in 2022 when the output gap is expected to close.

The US dollar was hung out to dry off on the back of the decisions as this tapering stands in stark contrast to the Federal Reserve which is set to meet next week and decide on its own monetary policy settings.

The Fed has continued to emphasise that it stands pat on monetary policy in order to ensure they meet their mandates.

The divergence between central banks is something that will be in focus in weeks to come and is a bearish factor for the greenback.

USD/CAD technical analysis

Off the bat, there are prospects for further downside considering the hawkishness at the BoC.

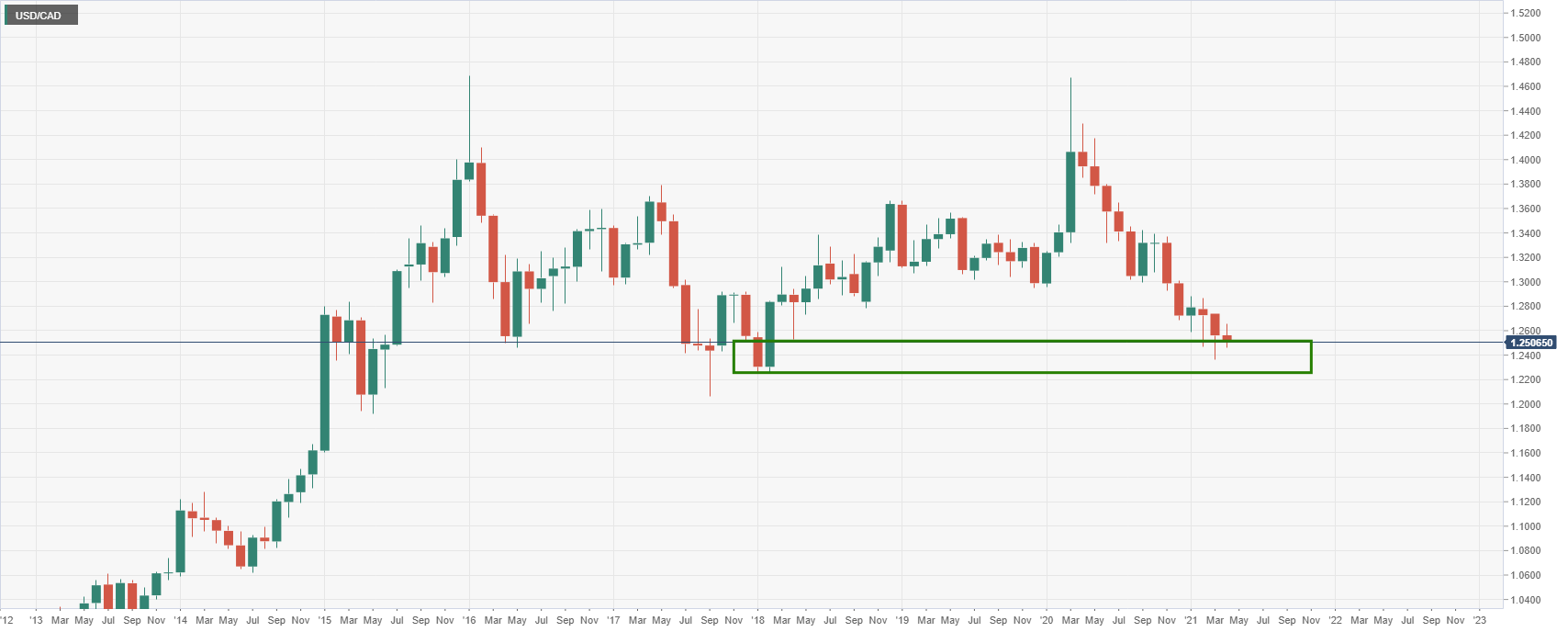

On the monthly chart, the prior month’s wick is under attack and would be expected to be filled in on the lower time frames in price action over the comings days and weeks:

Weekly chart

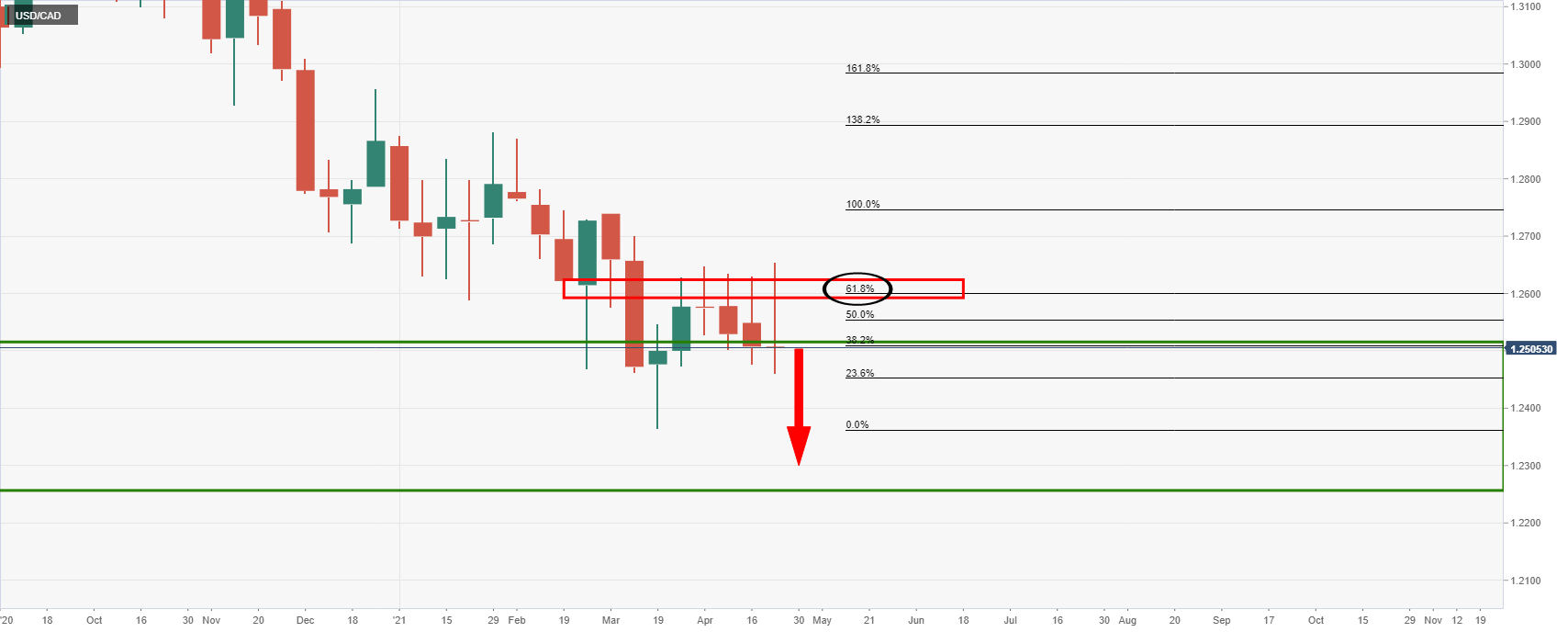

Daily chart

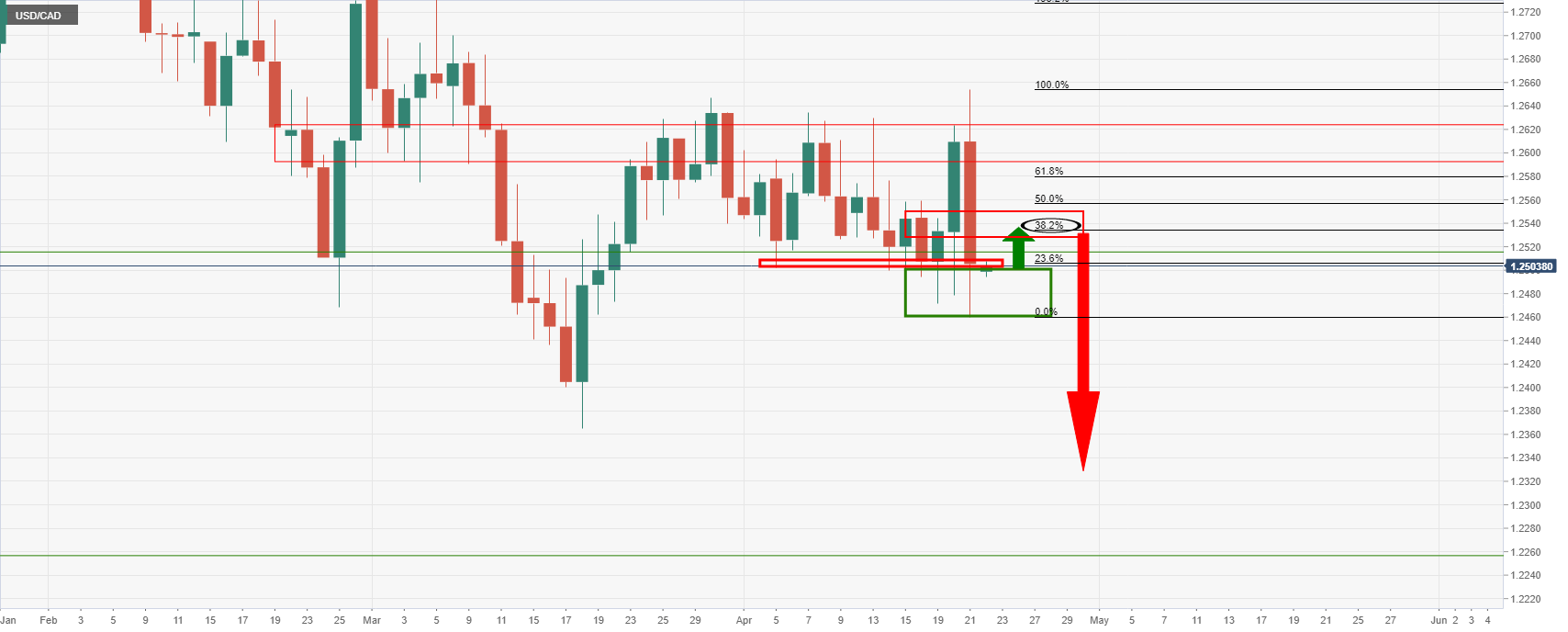

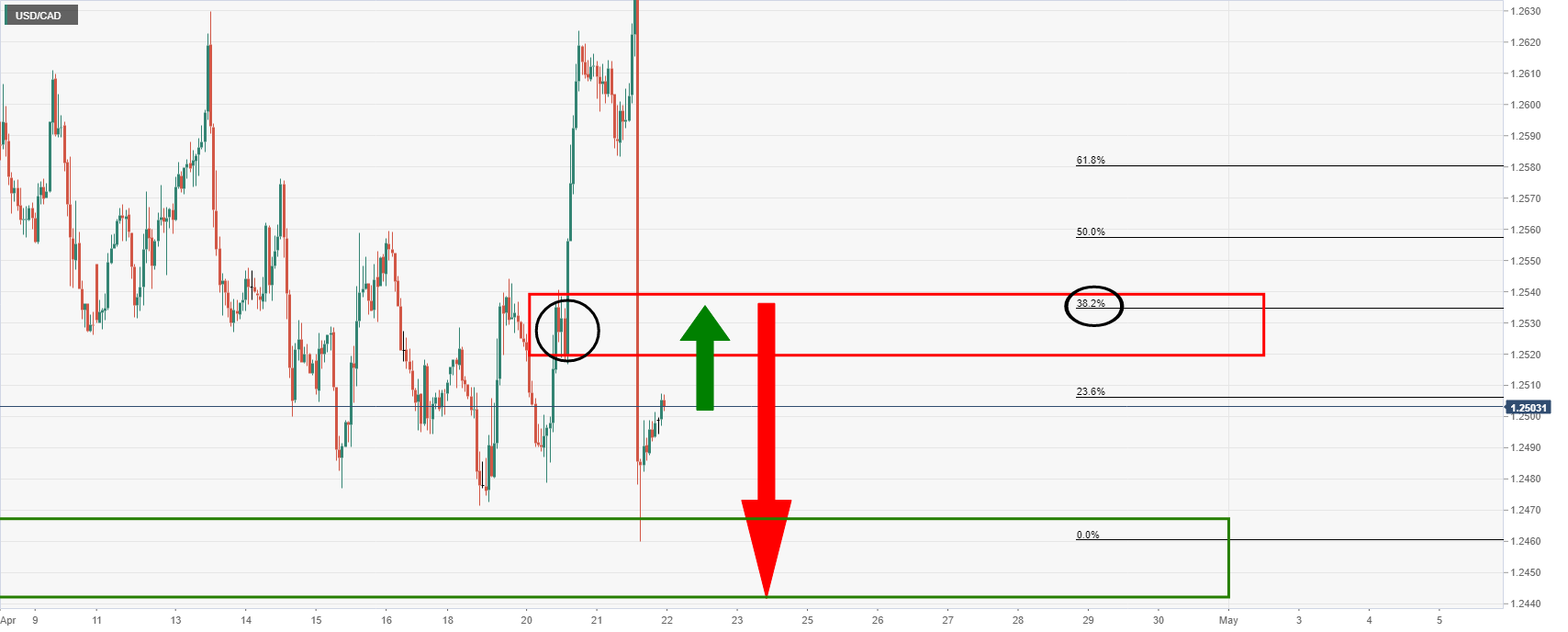

A 38.2% Fibonacci retracement if the current resistance breaks will be on the cards ahead of the next downside leg deeper into monthly support.

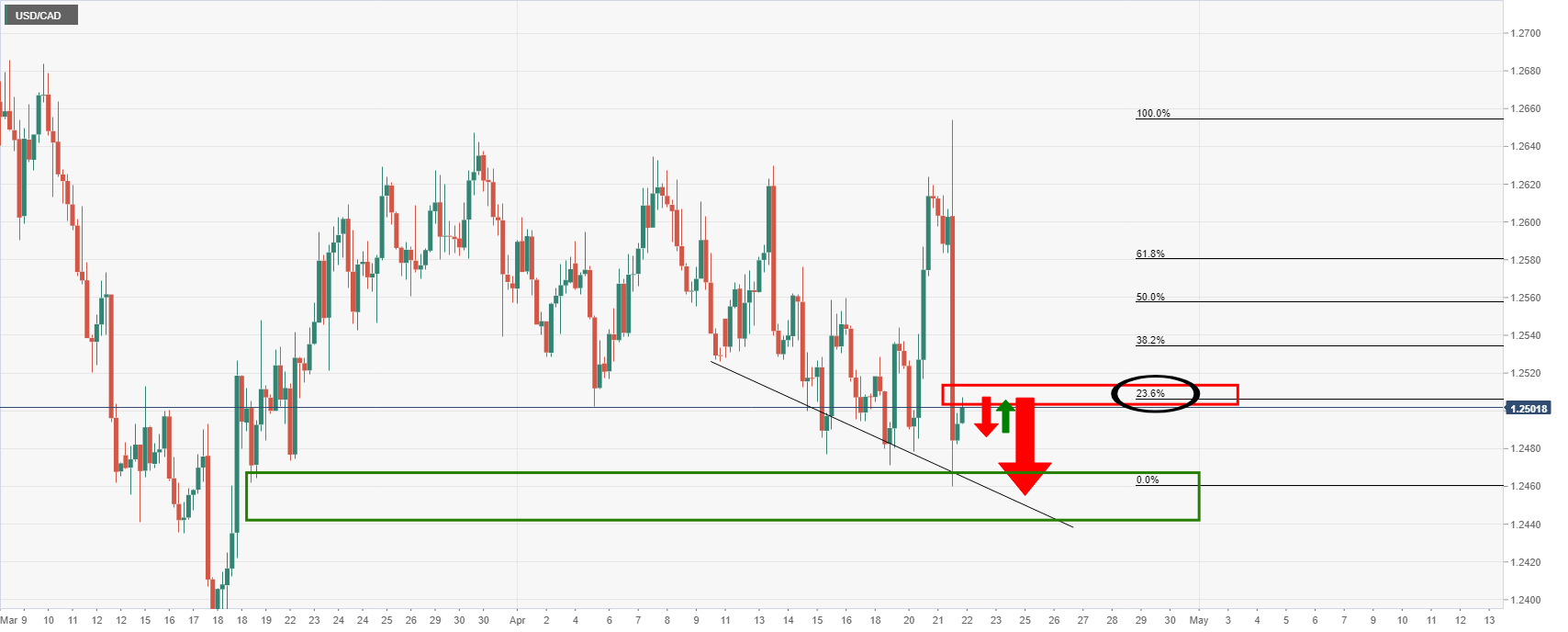

However, the confluence of the 23.6% Fibo, prior closing lows and support structure along with the BoC fundamentals makes for a compelling downside case from this juncture.

Optimal shorting entries can be monitored on a 4-hour time frame looking for bearish structure on failures of current resistance.

From a 1-hour perspective, however, the 38.2% Fibo meets with a prior structure which could be tested again prior to the next bearish impulse: