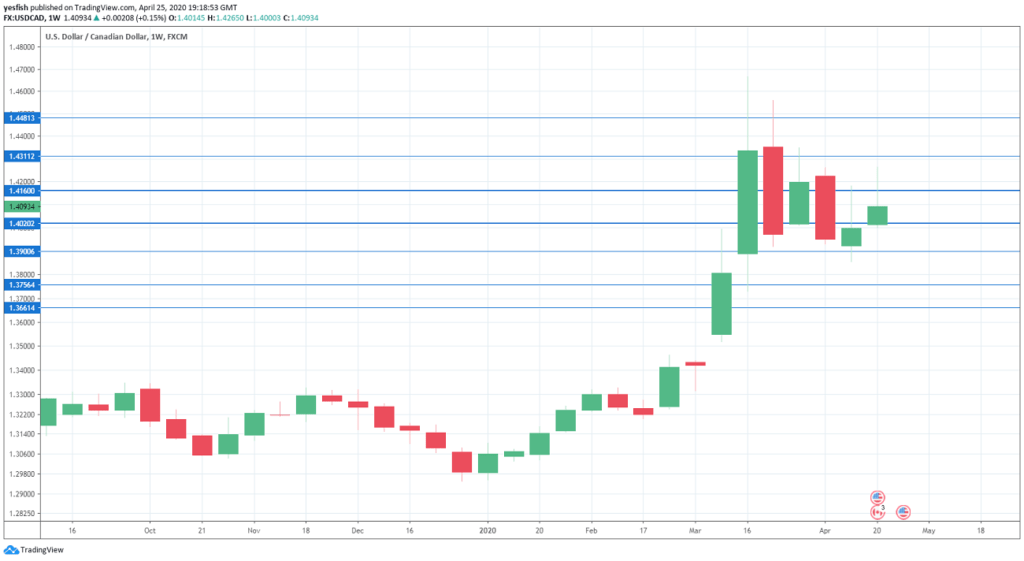

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- GDP: Thursday, 12:30. Canada releases GDP on a monthly basis. Canada’s economy slowed to 0.1% in January, down from 0.3% a month earlier. The downturn is expected to continue in February, with a forecast of 0.0%.

- Raw Materials Price Index: Thursday, 12:30. The indicator has posted back-to-back declines, as inflation levels remain low. In February, the index fell by 4.7%, worse than the estimate of -2.0 percent. This marked the sharpest decline since July. We now await the March data.

- Manufacturing PMI: Friday, 13:30. After six successive readings pointing to expansion, the indicator slipped below the 50.0 level in March, falling to 46.1 points. Will we see an improvement in the upcoming release?

USD/CAD Technical Analysis

Technical lines from top to bottom:

1.4480 was an important cushion in April 2000. 1.4310 is next.

1.4159 (mentioned last week) has some breathing room in resistance.

1.4019 has switched to support after USD/CAD gained ground last week.

The round number of 1.39 has some breathing room in support. 1.3757 is next.

1.3660 is the final support level for now.

I remain bullish on USD/CAD

The outlook for the Canadian dollar remains negative, as economic numbers are reflecting the economic fallout due to Covid-19. Risk appetite for minor currencies like the Canadian dollar remains weak. As well, low oil prices are also weighing on the Canadian dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!