In the US, headline and core inflation both rose slightly, from 0.0% to 0.2%. PPI was also weak, with the headlined and core releases coming in at a negligible 0.1%. Unemployment claims surged to 853 thousand last week, up from 712 thousand. This points to weakness in the labor market, as the economy continues to struggle. The week wrapped up on a positive note, as UoM Consumer Sentiment improved to 81.4 in December, up from 77.0 beforehand.

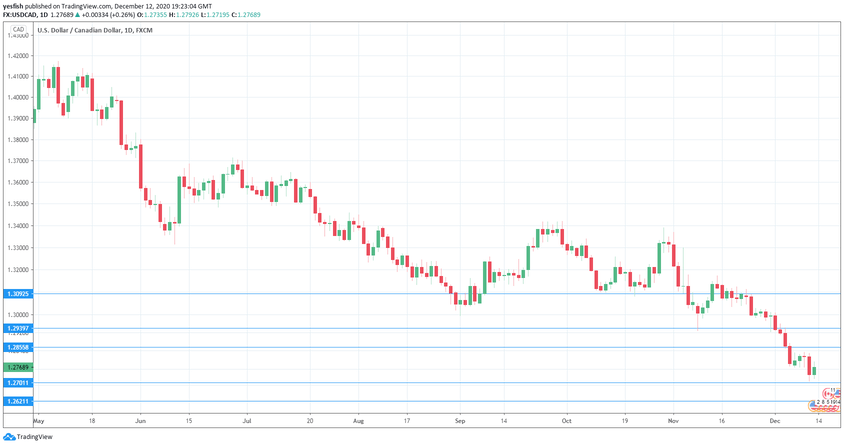

USD/CAD daily chart with support and resistance lines on it. Click to enlarge: