- Manufacturing PMI: Monday, 14:30. Manufacturing improved slightly in November, climbing from 55.5 to 55.8. Will the upturn continue in December?

- Raw Materials Price Index: Tuesday, 13:30. This inflation indicator rebounded in October with a gain of 0.5%, after a decline of 2.2% beforehand. We now await the November data.

- Trade Balance: Thursday, 13:30. Canada continues to post trade deficits. In October, the deficit rose to C$-3.8 billion, its highest level since March 2019. Will we see an improvement in November?

- Ivey PMI: Thursday, 15:00. The PMI slowed to 52.7 in November, its lowest level since May. This points to weak expansion, as the 50-level separates expansion from contraction. We now await the December data.

- Employment Report: Friday, 13:30. Employment Change slowed to 62.1 thousand in November, but easily surpassed the forecast of 22.0 thousand. In November, the unemployment rate fell for a sixth straight month, dropping from 8.9% to 8.5%. The December data could affect the movement of USD/CAD.

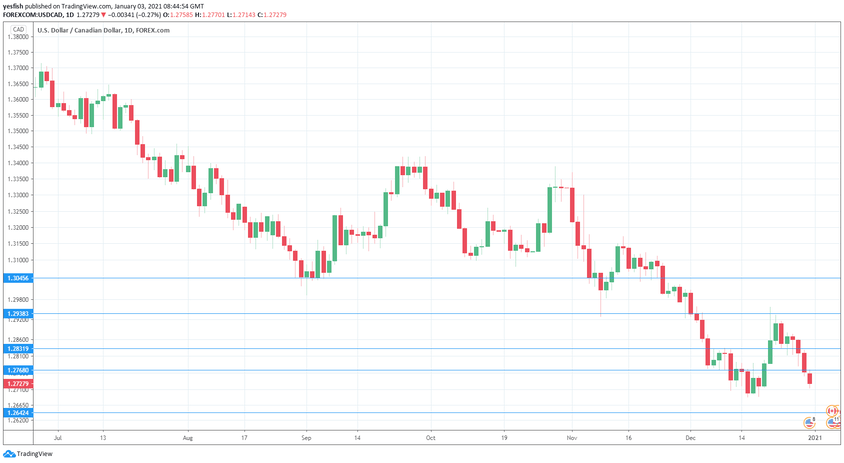

Technical lines from top to bottom:

We start with resistance at 1.3046.

1.2938 switched to resistance at the start of December, when USD/CAD started its slide.

1.2831 is the first line of support.

1.2768 (mentioned last week) is next.

1.2642 has held in support since April 1.

1.2578 is next.

1.2490 is the final support level for now.

.

I am neutral on USD/CAD

The US dollar remains under pressure, and we could see some movement around the pair in mid-week, with the US runoff election in Georgia on Tuesday. The results will determine which party will control the US Senate. Traders can also expect volatility on Friday, with the release of key employment data in both Canada and the US.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!