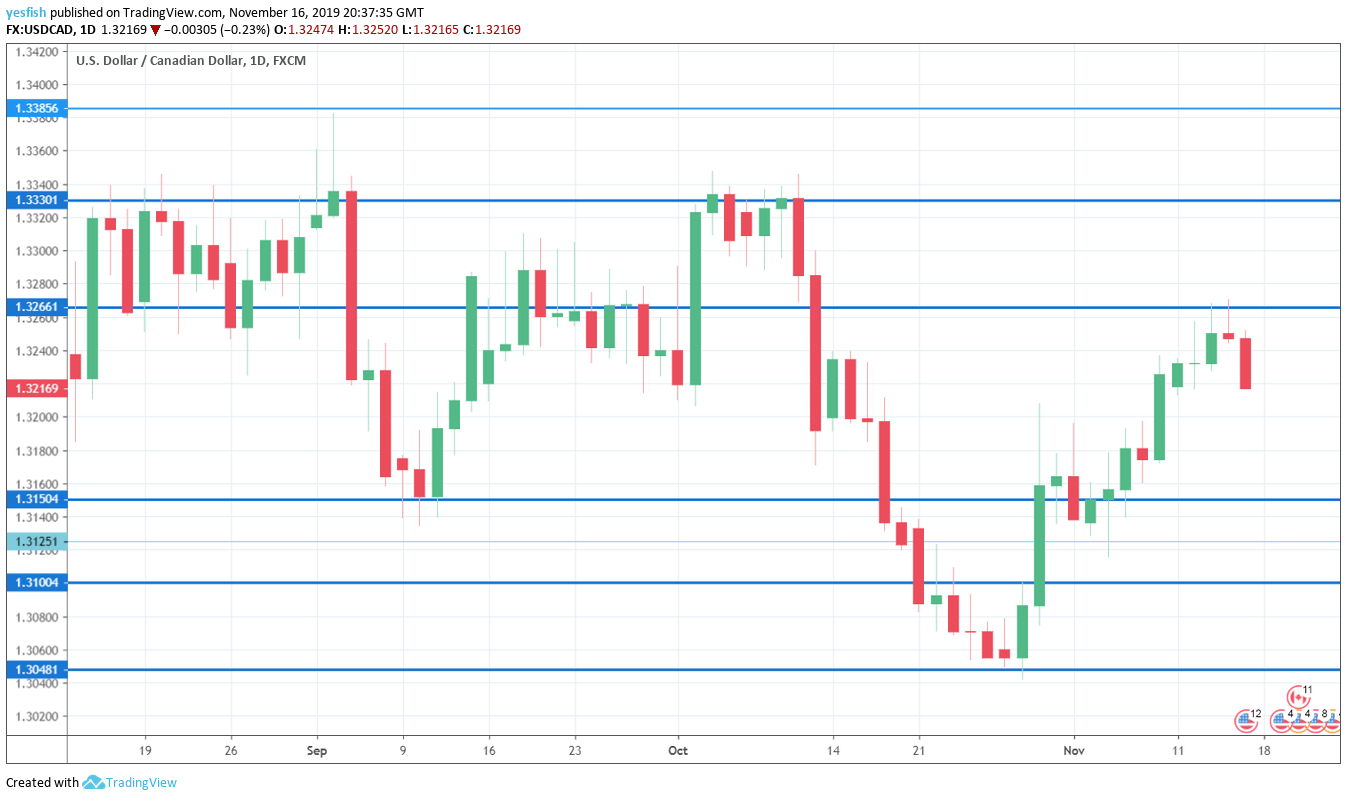

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing Sales: Tuesday, 13:30. Manufacturing sales rebounded in August, posting a gain of 0.8% after two declines. However, investors are braced for a decline of 0.5% in September.

- Inflation Data: Wednesday, 13:30. Consumer inflation remains subdued, posting three declines in four months. In September, CPI declined by 0.4%. The core reading came in at a flat 0.0%. We now await the October data.

- ADP Nonfarm Employment Change: Thursday, 13:30. This employment indicator slowed to 28.2 in September, marking a 4-month low. Will we see an improvement in October?

- BoC Financial System Review: Thursday, 15:30. The Bank of Canada publishes its overview of the financial system twice a year. Apart from data about the banks’ situation, the publication also includes economic data.

- Retail Sales: Friday, 13:30. In August, Canadians squeezed their spending: retail sales slipped by 0.1% on the headline and 0.2% on the core. We will now get an update for September. Consumer spending is closely watched by investors and significant deviation from expectations could certainly move the Canadian currency.

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 1.3565.

1.3445 has remained intact since the first week of June. 1.3385 is next.

1.3330 has held since early September.

1.3265 is an immediate resistance line.

1.3150 is providing support.

1.3100 has some breathing room after USD/CAD posted gains last week.

1.3048 (mentioned last week) is protecting the round number of 1.3000, which has psychological significance.

1.2916 was last tested in October 2018.

1.2830 is the final support line for now.

I am neutral on USD/CAD

The Canadian dollar dodged a bullet last week, as it managed to recover from losses in the middle of the week. There are indications that the U.S. and China are close to reaching a limited trade deal, and if there are signs that this is the case, we’re likely to see an improvement in risk appetite, which would be bullish for the Canadian dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!