Dollar/CAD reached new highs as oil hit new lows, but managed to stabilize once again. What’s next? The GDP report stands out. Here are the highlights and an updated technical analysis for USD/CAD.

Oil prices suffered another tumble, hitting the lowest levels in a year. The black gold fell alongside stocks. When they recovered, petrol prices recovered as well, but the Canadian Dollar remained on the back foot. US durable goods orders missed expectations and added to warning signs about the global economy.

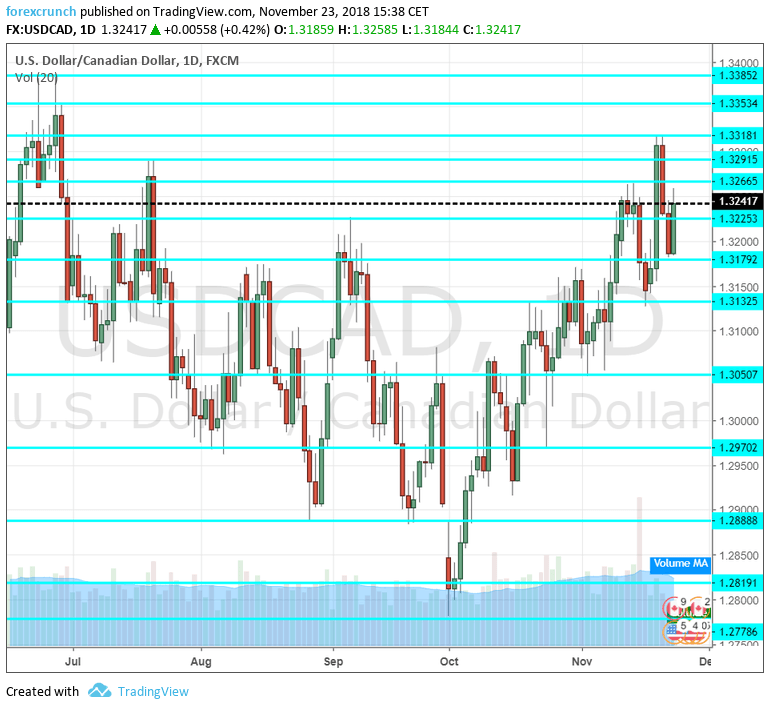

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Current Account: Thursday, 13:30. Canada suffers from a chronic current account deficit, contrary to its occasional surpluses in the narrower monthly trade balance measure. The deficit stood at C$15.9 billion back in Q2. We will now receive figures for Q3.

- GDP: Friday, 12:30. The Canadian economy grew by only 0.1% m/m in August, an unimpressive outcome. The figure for September concludes the third quarter and is of higher importance for the C$.

- RMPI: Friday, 13:30. The Raw Materials Price Index fell in the past two months, sliding by 0.9% in September. Will it rise in October? Prices of materials feed into consumer prices.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD continued its upside assault and temporarily topped 1.3295 (mentioned last week).

Technical lines from top to bottom:

1.3385 was the high point seen in May and towers above. 1.3350 was a stepping stone on the way and on the way down around the same time.

1.3320 was the high point in late November. 1.3295 capped the pair back in July.

Lower, 1.3265 was the high point in mid-November. 1.3225 played a role in capping USD/CAD back in September.

1.3175 was a swing low in late November and it is followed by 1.3125 which was also a low point, earlier in the month.

Below 1.3000 we find the late-October trough of 1.2970. 1.2880 was a double-bottom in September and in August.

1.2820 was a stepping stone on the way up in late May. 1.2780 was the low point in October 2018.

1.2730 provided support earlier in May. Lower, 1.2630 held the pair down back in April.

Further down, 1.25 is a critical round number and also 0.80 on CAD/USD.

I am bullish on USD/CAD

The recovery in oil prices may be temporary. Dark clouds are gathering over the global economy and the loonie, a risk currency, may suffer.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!