The Canadian dollar is riding higher with oil prices. The correlation hasn’t always been there: during long months, domestic data from Canada as well as the ebb and flow of the greenback have shaped trading in USD/CAD, leaving oil prices on the sidelines.

Yet the rise in oil prices is quite significant and we do not have too many economic figures coming out in the holiday week between Christmas and New Years’.

Oil prices are rising due to a blast in a pipeline in Libya, the war-torn country that provides sweet crude to Europe and other countries. It seems serious:

“The pipeline explosion in Libya is a lot more serious as it may take a long time to restore, which can be a long-term driver of oil prices,” Kim Kwangrae, a commodities analyst at Samsung Futures Inc. in Seoul, said by phone. “The disruption is considered detrimental enough to dry up some of the global glut.”

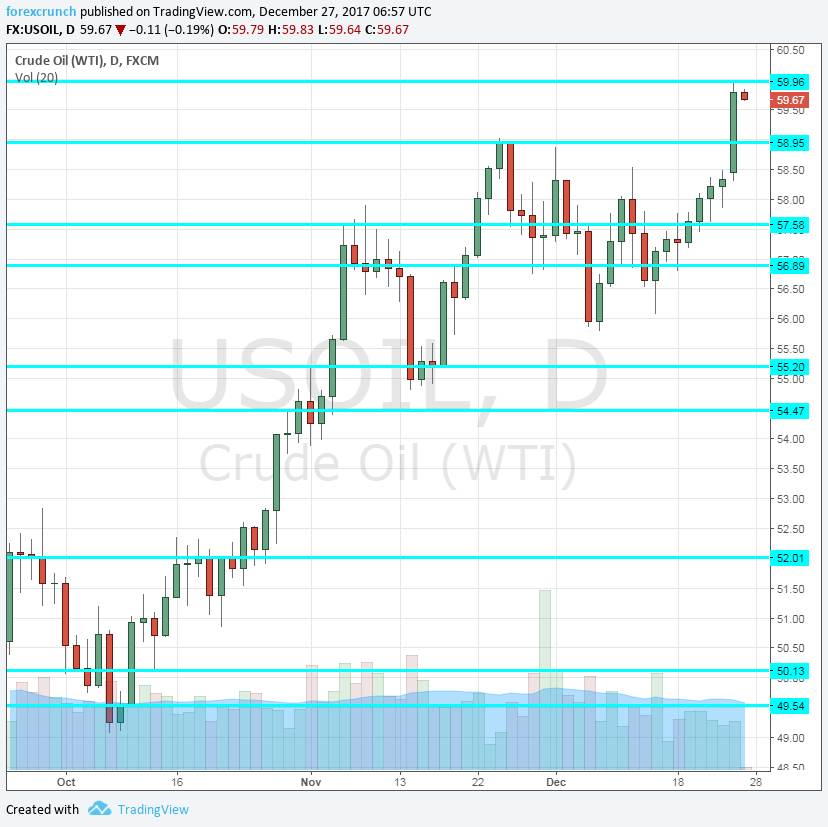

WTI Crude Oil climbed to above the $60 level, jumping above the previous level of $58.95. It is thus extending the previous gains and reaching the highest post-crash levels: the highest since mid-2015.

For the Canadian dollar, this means trading under 1.27. The loonie is struggling to hold onto support at 1.2670, which served as a line of support back in mid-November.

Further support awaits at 1.2630, a swing low in December, and then 1.2540. All in all, Dollar/CAD is now at the bottom of the range that characterized it since breaking higher. Will it return to the lower range?

More: Top Trades For 2018: Buy EUR/USD, Buy AUD/NZD, Sell USD/CAD – SocGen