- The USD/CAD pair paused the rally and fell on NFP.

- Further catalyst for the pair are Fed meeting minutes and US ISM survey.

- Technical stance looks mixed and the price may find a chance to rally to the 50-period SMA (4-hour chart)

The US Dollar paused its rally after the NFP report and started a corrective retracement to the downside. The USD/CAD pair was trying to build a bullish momentum from the 1.2000 key psychological support zone and marked a local high near the 1.2500 zone where it met fresh sellers and now remains in a broad range.

The earlier rally in the pair stemmed from a stronger Greenback amid Fed’s increased hawkish tone to tighten the monetary policy and curtail the bond-buying program sooner than expected. Christopher Waller also joined the hawkish group of FOMC with Kaplan.

USD/CAD reacts to NFP

As soon as the NFP data released, the first reaction of the USD/CAD pair was positive and it tried to rally. However, the bulls couldn’t hold the upstream and the market reversed its course of action. The pair fell for almost 70 pips and closed the week in neutral territory.

The US economy added 850,000 private jobs while the wage growth remained stable at around 3.6%. This facet of data is very strong and beats the market expectations. But the unemployment rate rose from 5.8% to 5.9% which indicated a slow recovery in the economy and hinted that the Fed could act less hawkish now.

What’s next for USD/CAD?

The USD/CAD pair can find a significant impact from the Fed’s meeting minutes due next week along with the US ISM survey data. Moreover, the crude oil prices can also impact the USD/CAD. Crude oil prices can see a retracement as they have gained a lot and may observe profit-taking.

USD/CAD technical outlook: Key levels to watch

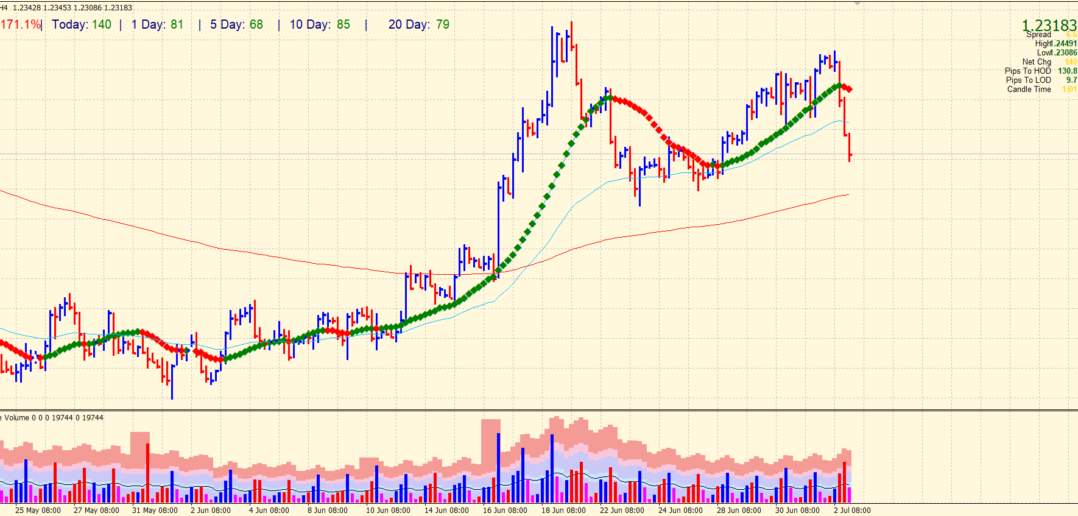

The technical perspective for the USD/CAD is mixed as the daily timeframe is neutral to bullish while the 4-hour chart tells a different story (testing 2 weeks old swing lows below 50-period SMA). Such a scenario indicates that the pair will likely remain rangebound and will require a catalyst to initiate a trend move.

The fall of 70 pips after NFP on the 4-hour chart shows a falling knife pattern (fall at a zero-degree angle) which is a strong bearish pattern. As long as the recent swing low (1.2250 – 1.2275) holds, there are chances for the pair to recover. However, the probability to break the support of swing low is higher at the moment.

The only positive factor for the pair could be the ultrahigh volume of the last 4-hour bar which shows potential profit-taking by the sellers here. This may allow a relief rally for the pair. On the upside, 50-SMA at 1.2360 area can provide initial resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.