- Powell prefers a meeting-by-meeting approach in future policy decisions.

- Investors are awaiting more talks on the US debt ceiling.

- Canadian retail sales experienced a 1.4% decrease in March.

Today’s USD/CAD outlook is bullish. On Monday, the dollar held steady as negotiations regarding the US debt ceiling were scheduled to resume. Federal Reserve Chair Jerome Powell also prefers a meeting-by-meeting approach in future policy decisions.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Investors eagerly anticipate a crucial meeting between US President Joe Biden and House Republican Speaker Kevin McCarthy to discuss the debt ceiling. Both sides described a positive phone call on Sunday, further fostering optimism regarding the debt limit. This, in turn, provided support for the dollar.

On Friday, the Canadian dollar weakened slightly against the US dollar but maintained a significant portion of its weekly gain. This was influenced by two factors: a decline in domestic retail sales in March and a pause in negotiations to raise the US debt ceiling.

Throughout the week, the Canadian dollar saw a 0.3% increase following the data release on Tuesday, indicating a rise in the annual inflation rate in April. This marked the first increase in 10 months.

Money markets indicate an approximately 40% probability of the Bank of Canada lifting its benchmark interest rate by September. Before the inflation data, investors had expected a rate hike.

According to Statistics Canada’s report on Friday, Canadian retail sales experienced a 1.4% decrease in March compared to February. Lower sales primarily drove the decline at motor vehicle and parts dealers and gasoline stations. However, a preliminary estimate showed a 0.2% increase in sales for April.

USD/CAD key events today

Investors will watch the US debt ceiling negotiations today as they do not expect key releases from Canada or the US.

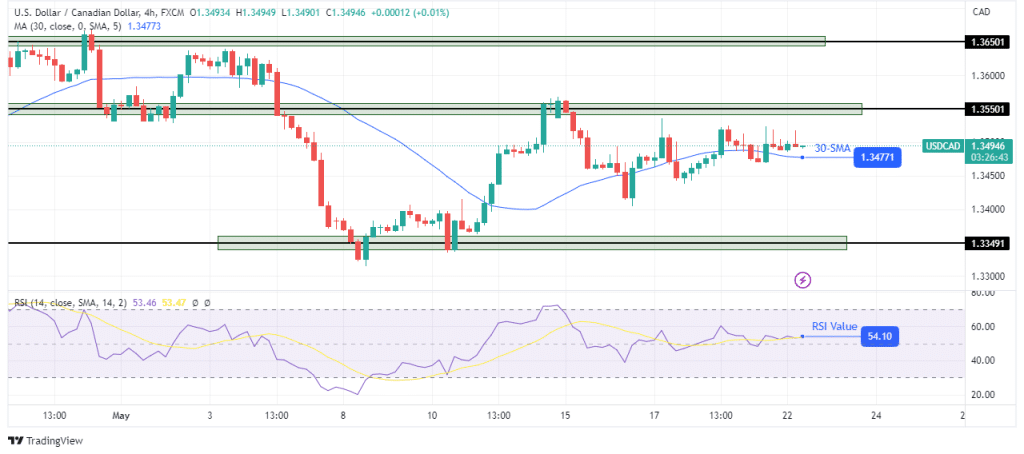

USD/CAD technical outlook: Bulls dominating at the 30-SMA.

On the technical side, USD/CAD is slightly bullish because the price is above the 30-SMA with the RSI over 50, supporting bullish momentum. However, there is still a battle for control at the SMA. The price is yet to detach from the SMA and show the side that has won.

–Are you interested to learn more about forex trading apps? Check our detailed guide-

Since bulls are stronger now, we might see the price retest the 1.3550 resistance level. A break above this level would finally confirm a winner in the battle. A higher high would also strengthen the bullish bias.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.