- Investors are bracing for a possible 75-bps hike and a looming recession.

- The US dollar has hit a one-month high against the Canadian dollar.

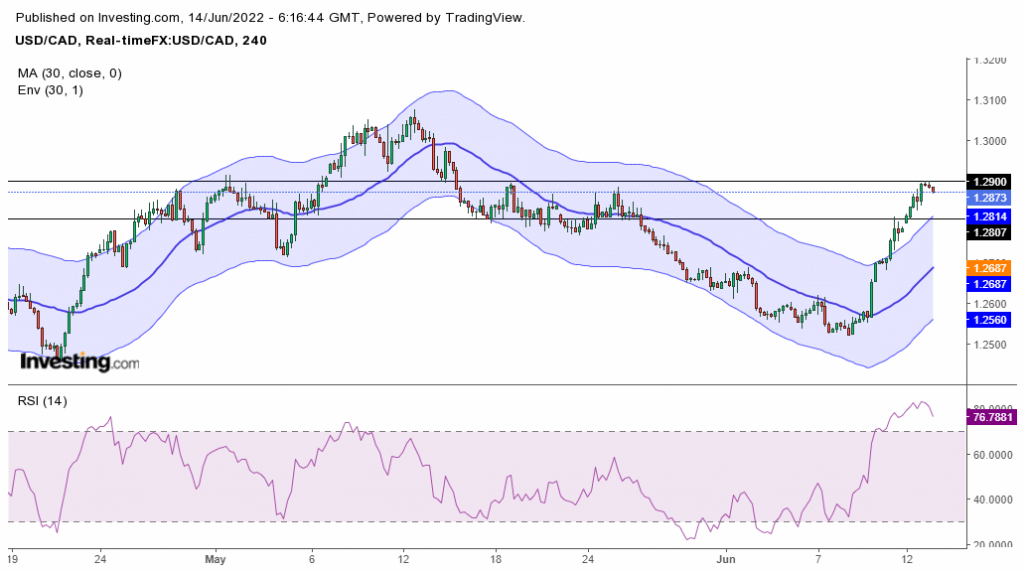

The USD/CAD outlook is bullish as the pair closed Monday on a solid bullish candle, showing massive momentum. The pair is pulling back from its highs on Tuesday as investors take profits. This bullish move will return as investors are bracing for aggressive Fed rate hikes and a looming recession.

-Are you interested in learning about forex tips? Click here for details-

After the hot US inflation reading, there has been a scramble to bet on higher rate hikes in the markets. Investors are pricing in consecutive 75-bps hikes in June and July. This scramble has seen the US dollar soar to a fresh 20-year high and went above 105 as investors look for safety.

Even soaring oil prices could not protect the Canadian dollar against losses as the US dollar hit a one-month high against the currency.

“The dollar seems to be the stagflation hedge of choice. The market is starting to turn a lot more fearful,” said Bank of Singapore strategist Moh Siong Sim. “On the inflation front, things do not look good, and the Fed needs to respond.”

USD/CAD key events today

USD/CAD investors will be expecting some news from both the US and Canada. In the US, the producer price index for May will be a leading indicator for the consumer price index. Investors expect PPI to go up from 0.5% to 0.8% and core PPI to go up from 0.4% to 0.6%.

From Canada, the manufacturing sales data is expected to go down from 2.5% to 1.6%.

USD/CAD technical outlook: Bulls looking to hit 1.3000

Looking at the 4-hour chart, we see a strong uptrend shown by the sharp move to 1.2900. The price is trading above the 30-SMA, and the RSI is overbought. This trend could continue as bulls are showing massive strength, as seen in how the price has broken and is trading outside its envelope.

-Are you interested in learning about the forex basics? Click here for details-

At 1.2900, the price could do one of two things. It could break above the level and push towards 1.3000 or retrace the recent move by pushing lower to 1.2800 before going higher. The bias for this pair is bullish and will remain so if the price keeps trading above the 30-SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money