- USD/CAD quickly reversed an intraday dip to 1.2690-85 region, albeit lacked follow-through.

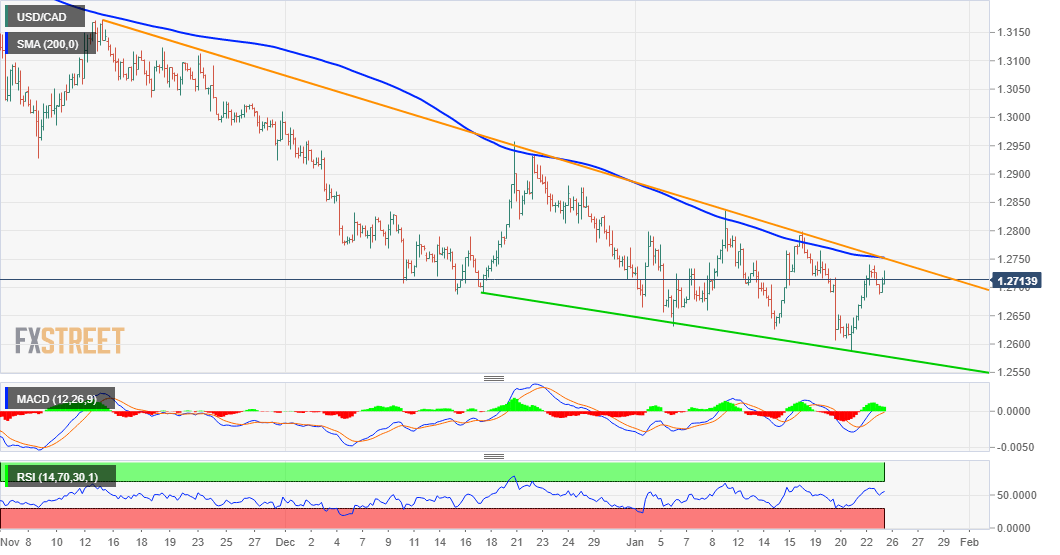

- The falling wedge formation suggests that the pair might have bottomed out in the near-term.

- Bulls might still wait for a sustained move beyond a downward-sloping trend-line resistance.

The USD/CAD pair recovered over 40 pips from daily swing lows and moved back closer to the top end of its intraday trading range, albeit lacked any follow-through.

Currently hovering around the 1.2720 region, any subsequent positive move is likely to confront stiff resistance near the 1.2760 area. The mentioned barrier marks a downward sloping line, which, along with another trend-line, constitutes the formation of a bullish falling wedge pattern.

Meanwhile, technical indicators on the daily chart –

though have been recovering from the negative territory – are yet to reaffirm the bullish set-up. This makes it prudent to wait for a sustained move beyond the falling wedge resistance before positioning for any further appreciating move.

A convincing breakthrough will suggest that the USD/CAD pair has bottomed out in the near-term and mark a bullish breakout. This, in turn, will set the stage for a move beyond the 1.2800 round-figure mark, towards testing the next relevant resistance near the 1.2835 region, or monthly tops.

Some follow-through buying has the potential to push the USD/CAD pair further towards the 1.2900 round-figure mark, above which bulls are likely to aim to test the 1.2955-60 supply zone. The momentum could further get extended and assist the pair to reclaim the key 1.3000 psychological mark.

On the flip side, any meaningful slide is likely to find decent support and might be seen as a buying opportunity near the 1.2630-25 horizontal level. This should help limit the slide near the 1.2600 mark, which is followed by the falling wedge support, currently near the 1.2580-75 zone.

A sustained break below will negate the constructive set-up and turn the USD/CAD pair vulnerable to prolong its recent, well-established bearish trend, extending from March 2020.

USD/CAD 4-hourly chart

Technical levels to watch