- USD/CAD bulls gearing up for a test of Tuesday’s high.

- Bullish bias intact whilst the spot holds above the 21-HMA.

- Critical support awaits at 1.2607, RSI stays bullish.

USD/CAD reverses an early dip to near the 1.2610 region, looking to recapture the 1.2650 mark. The rebound in the major can be attributed to the relentless rise in the US dollar across the board, as Treasury yields hold firmer ahead of President Joe Biden’s infrastructure plan.

Meanwhile, a minor retreat in WTI prices, following the mixed API crude stocks data, weighs on the resource-linked Loonie. This, in turn, renders positive for the USD/CAD pair. For the CAD traders, the focus will remain on the OPEC and its allies (OPEC+) meeting due this Thursday.

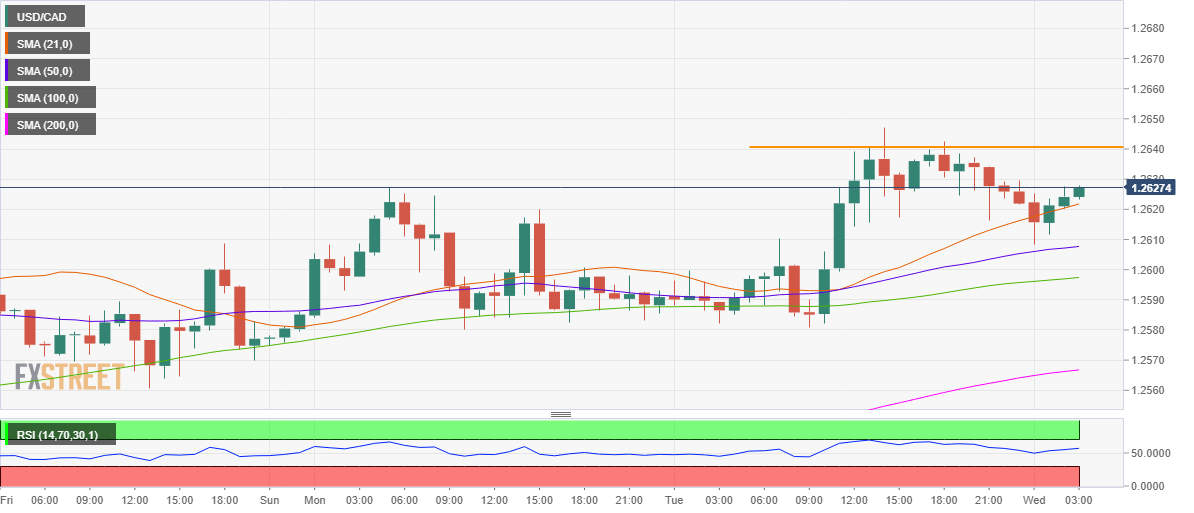

Looking at it technically, the price holds comfortably above the bullish 21-hourly moving average (HMA) at 1.2622.

USD/CAD: Hourly chart

The Relative Strength Index (RSI) pointing northwards above the central line, suggesting the sentiment continues to favor the bulls.

Therefore, a test of the horizontal trendline resistance at 1.2640 remains on the cards, above which the buyers need to find a strong foothold above Tuesday’s high of 1.2647.

Alternatively, an hourly close below the 21-HMA support could call for a test of the upward-sloping 50-HMA at 1.2607, where the daily low coincides.

Further south, the 100-HMA cushion at 1.2697 could get tested if the selling pressure intensifies.

USD/CAD: Additional levels