The USD/CAD price plunged, extending the decline as the DXY is into a corrective phase. The pair escaped from a major up channel, signaling reversal. Unfortunately, the breakdown wasn’t confirmed yet, so we cannot exclude a temporary rebound.

–Are you interested to learn more about forex robots? Check our detailed guide-

The pair has resumed its drop as the USD was punished by the US Advance GDP, unemployment claims, and pending homes sales dismal data. Anything could happen today as the Canadian and US economic figures will drive the price.

The Canadian GDP is expected to drop by 0.3% in May after a 0.3% drop in April. On the other hand, the US Core PCE Price Index could register a 0.6% growth versus a 0.5% increase in the previous reporting period.

Some poor US data today could force the greenback to resume its decline. For example, the Chicago PMI is expected to drop from 66.1 to 64.2 points, while the Revised UoM Consumer Sentiment could remain steady at 80.8 points. Furthermore, the Personal Income and the Personal Spending will be released as well.

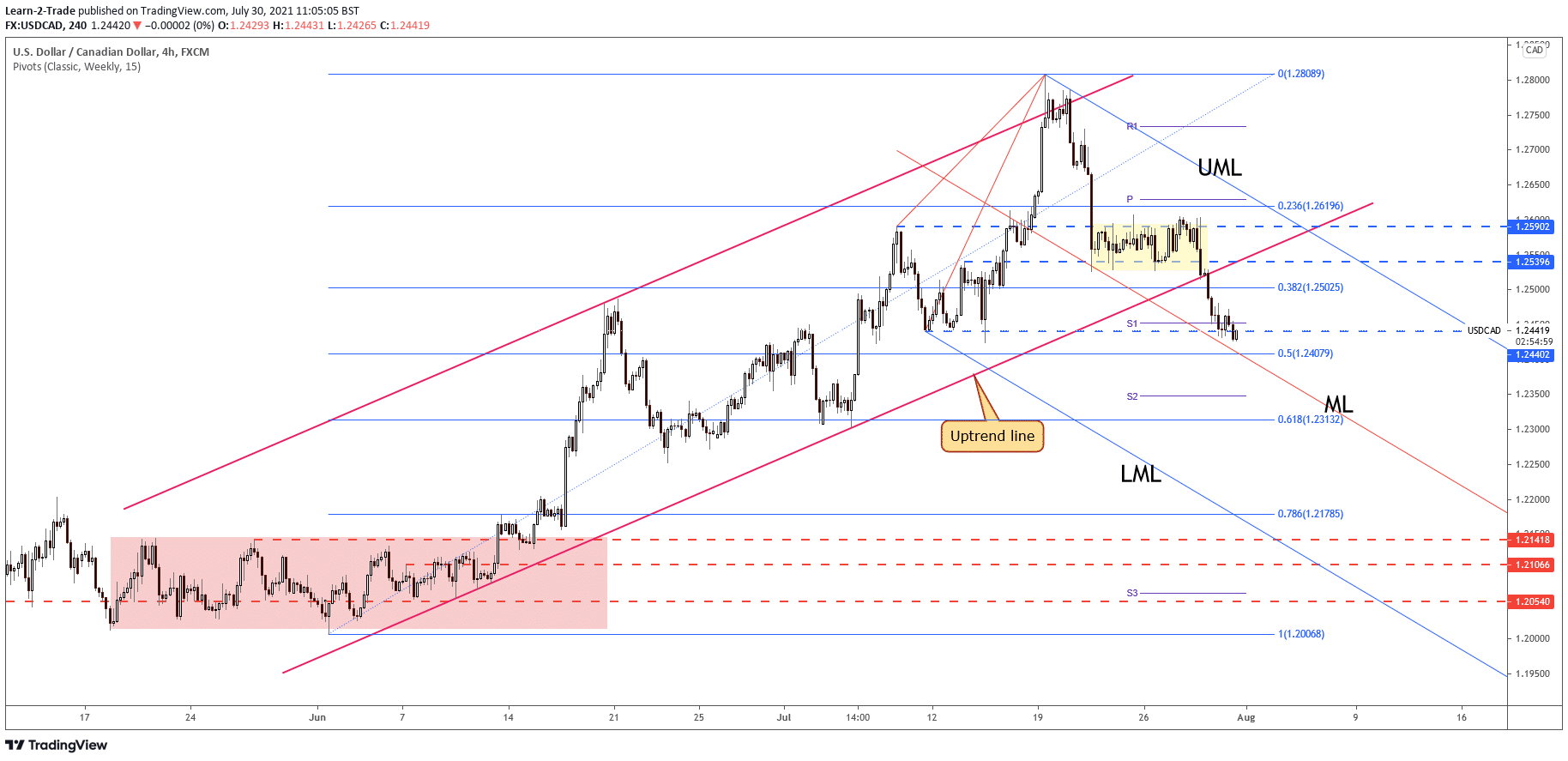

USD/CAD price technical analysis: Key levels to watch

The USD/CAD pair resumed its decline after escaping from the minor range between 1.2590 and 1.2539. It has ignored the uptrend line, and now it stands at the 1.2442 level. Technically, 1.2440 is seen as a static support level.

Closing below it signals further decline towards the 50% retracement level and down to the descending pitchfork’s median line (ML). USD/CAD could rebound if it stays above 1.2440 and if it comes back above the weekly S1 (1.2452).

Personally, I would have liked to see the uptrend line retest before resuming its correction. A temporary bounce back could help us to catch a new downside movement. Now, it’s risky to sell it as it stands right above the confluence area formed at the intersection between the 50% retracement line with the descending pitchfork’s median line (ML).

–Are you interested to learn more about buying cryptocurrencies? Check our detailed guide-

A valid breakdown through it signals a sharp drop, while a false breakdown could bring a short term rebound. USD/CAD could resume its drop even if it stays above the median line (ML).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.