- The USD/CAD risk reversals fell to three-week lows, indicating weakening demand for CAD puts (bearish bias).

- The data adds credence to USD/CAD’s pullback from the recent high of 1.3386 to 1.3150.

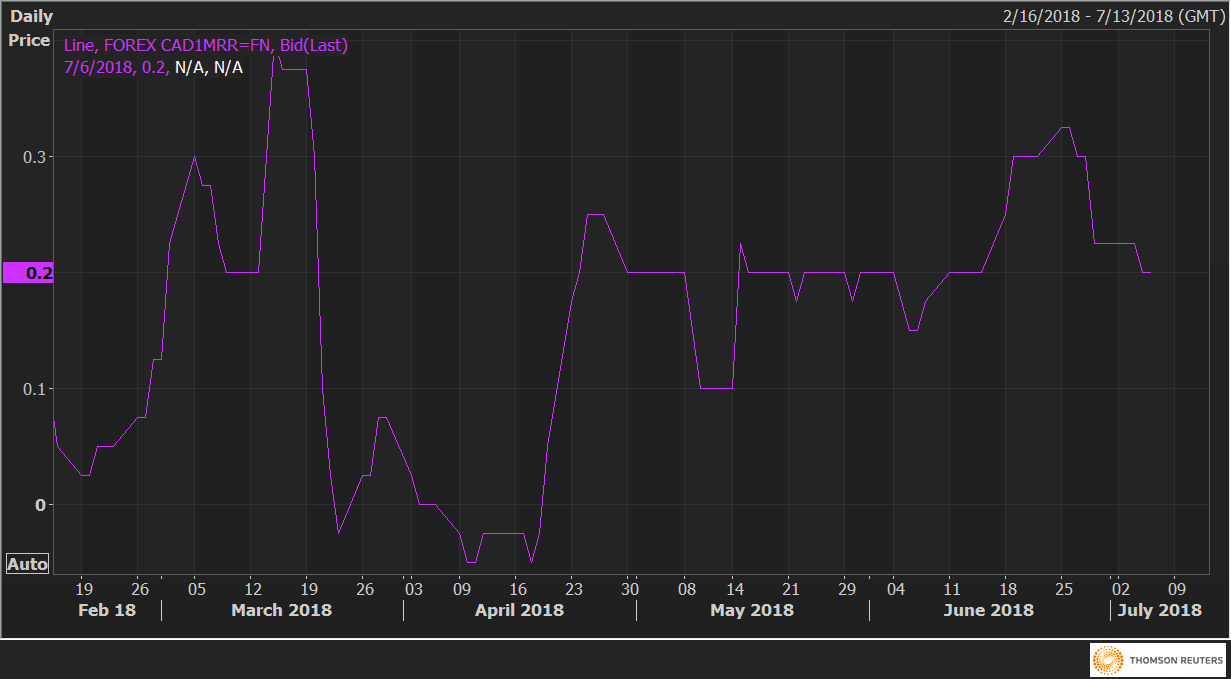

The USD/CAD one-month 25 delta risk reversals (CAD1MRR) are being paid at 0.20 CAD puts – the lowest level since June 15 vs recent high of 0.30 CAD puts.

The decline from 0.30 to 0.20 represents falling implied volatility premium for CAD puts.

Clearly, the demand for the CAD put options (bearish bets) has dropped in the wake of pullback in the USD/CAD from the recent high of 1.3386 to 1.3150.

CAD1MRR