- USD/CAD steps back from monthly highs.

- Overbought RSI conditions, strong resistance favor pullback.

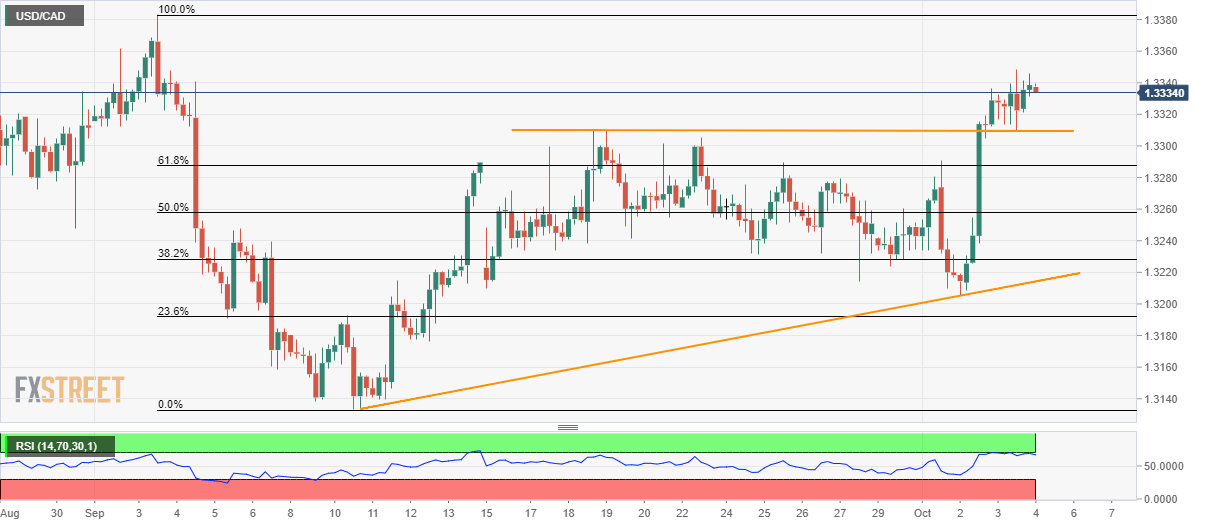

With its refrain from rising much beyond 1.3350, coupled with overbought RSI conditions, USD/CAD seesaws around 1.3340 during the Asian session on Friday.

The pair repeatedly fails to cross 1.3350 resistance-mark while overbought conditions of 14-bar relative strength index (RSI) indicate likely pullback.

In doing so, a horizontal-line connecting September 18/19 tops to Thursday’s bottom around 1.3310 could be sellers’ immediate favorite, a break of which could trigger fresh downside towards 61.8% Fibonacci retracement of September month declines, at 1.3287.

Should there be increased south-run past-1.3287, 50% Fibonacci retracement level of 1.3255 and 1.3230 could entertain bears ahead of challenging them with nearly a month-old rising trend-line close to 1.3310.

Alternatively, pair’s sustained run-up beyond 1.3350 could propel it to a falling trend-line since June 18, at 1.3365, before activating a rally to 1.3385 and 1.3400 resistances.

USD/CAD 4-hour chart

Trend: pullback expected