- The dollar was propelled higher by its safe-haven appeal.

- The US debt ceiling crisis increased fears of a default that could affect the global economy.

- The Canadian dollar plunged as oil prices fell on demand worries.

The USD/CAD weekly forecast is bullish as the dollar will likely continue shining as a haven amid economic uncertainty and debt ceiling discussions.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

Ups and downs of USD/CAD

USD/CAD had a bullish week because the dollar rose and the Canadian dollar weakened. The dollar was propelled higher by its safe-haven appeal. The Canadian dollar, on the other hand, fell as oil prices declined.

Investors sought safe-haven assets in the previous week after economic data showed a deteriorating US economy. Furthermore, the US debt ceiling crisis increased fears of a default that could affect the global economy. The US released data on employment and inflation.

Employment figures showed a slowing labor market as Fed rate hikes notably impacted the economy. Consumer and inflation data slowed last month, increasing bets of a Fed pause in June. However, the data also pointed to a looming recession that had investors scrambling for safety in the dollar.

Next week’s key events for USD/CAD

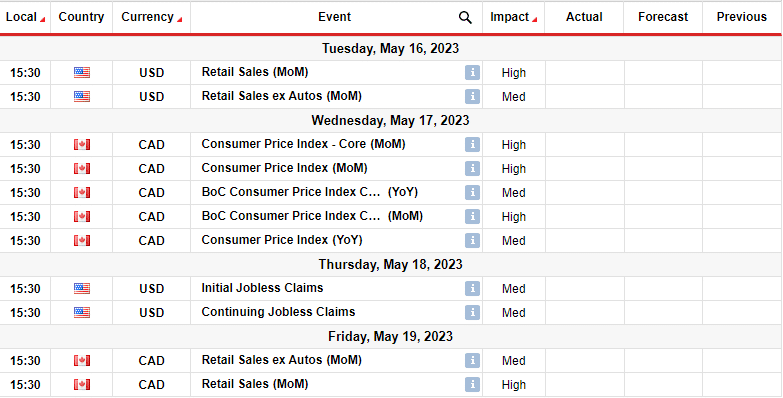

Investors will receive key releases from Canada and the US next week. Canada will release the all-important inflation report. This will give investors a clear picture of inflation in the country as the BOC pauses to let previous rate hikes take effect. A higher-than-expected reading could change the outlook for interest rates in Canada.

Investors will also get retail sales figures from both countries. These figures are a key indicator of consumer spending and inflation in the economies. Higher-than-expected readings would paint a picture of still-high inflation.

USD/CAD weekly technical forecast: Bulls charge toward the 1.3650 resistance.

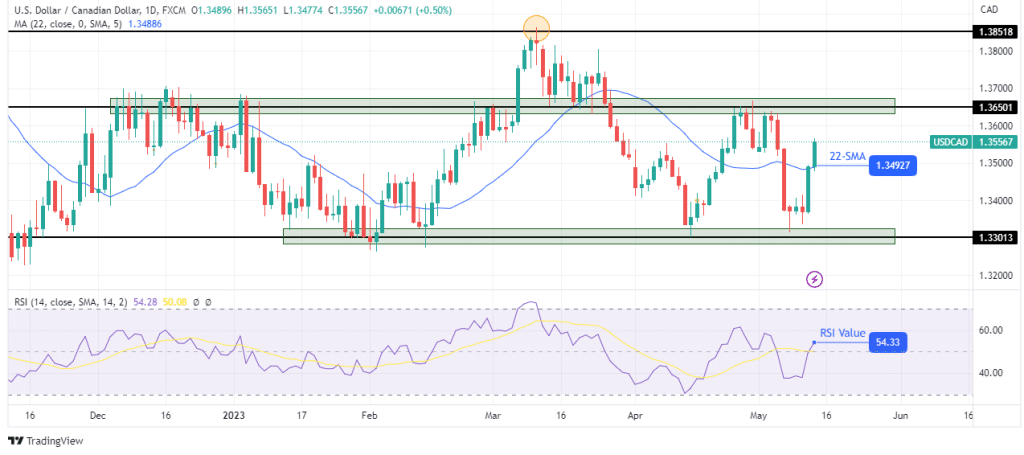

The short-term bias for USD/CAD in the 4-hour chart is bullish as the price trades above the 22-SMA and the RSI above 50. However, the price lacks direction on a larger scale as it has mostly chopped through the 22-SMA.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

It has also mostly moved sideways, with support at 1.3301 and resistance at 1.3650. At the moment, bulls are approaching the range resistance level.

If bullish momentum remains strong in the coming week, the price will likely break above this resistance and rise to retest the 1.3851 resistance. However, if it holds strong, we might see the price fall to retest the 1.3301.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.